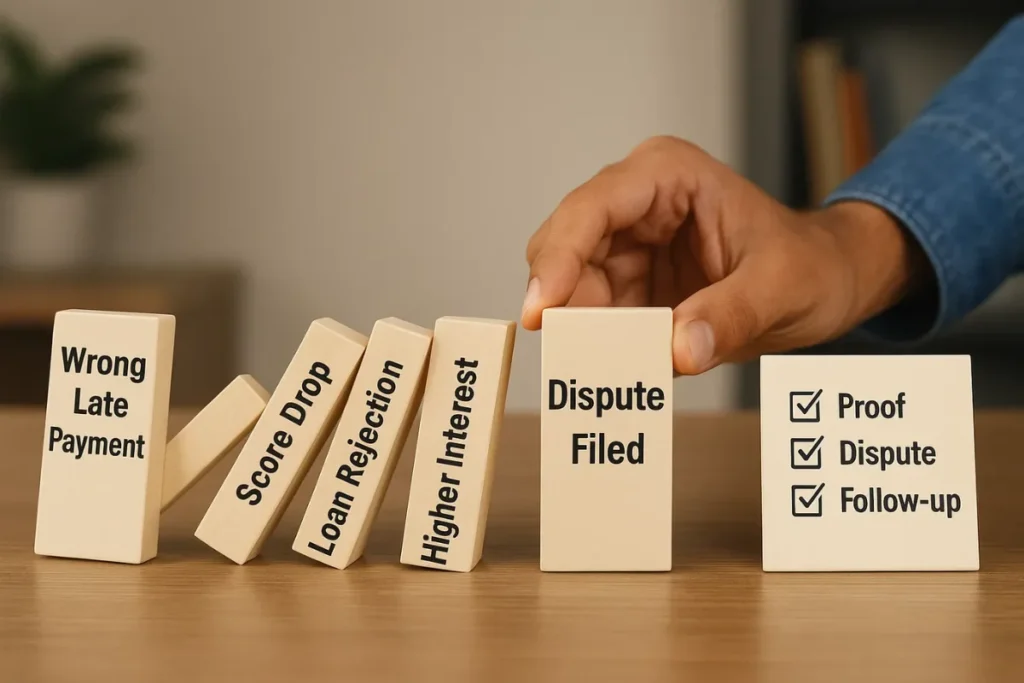

Seeing a late payment in your credit report when you clearly paid on time is frustrating. It can also hurt your chances of getting a personal loan, home loan, or even a simple credit card approval. The good news is that if the late mark is in error, you can dispute it and have it corrected.

This guide is written for Indian users and explains, step by step, how to avoid confusion.

How Wrong Late Payments Happen in India

Most late marks that are incorrect result from simple system gaps, not from anyone trying to cheat you. Common reasons are:

- The bank updated the data late to the credit bureau

- EMI got debited but reflected the next day due to the weekend or bank holiday

- NACH or ECS mandate issues, but you paid manually

- The loan was closed, but the final month was reported incorrectly

- Credit card bill paid, but the minimum due is marked as unpaid

- Bank merged accounts or changed the loan number, and created a mismatch

Kabhi kabhi payment ho jaata hai, but reporting miss ho jaati hai. That is why you must keep proof.

First Check: Is It Really Wrong

Before raising a dispute, confirm these points:

- Check the month where the late payment is showing

- Check the due date and the actual payment date

- Check whether it is an EMI or a credit card bill

- Check if it is marked as 30 DPD or just a late status

If you paid after the due date, even by a few days, the late fee is not incorrect. If the payment was on time but still marked as late, you should dispute it.

What Proof You Need Before You Dispute

Collect these documents in one folder:

- Bank statement showing debit of EMI or card payment

- Payment confirmation SMS or email

- Loan account statement or card statement

- Screenshot of payment transaction if paid via UPI or net banking

- NOC if this is related to the loan closure

Keep the proof clean and readable. Banks and bureaus respond faster when your evidence is clear.

Step-by-Step Dispute Process in India

Step 1: Download Your Latest Credit Report

Download the report from the bureau where the late mark is showing. Your report will have the account details and the Wise payment history.

Make sure you note:

- Account number or last four digits

- Name of lender

- The month where the late mark is showing

- Any reference or control number from the report

Step 2: Raise a Dispute on the Credit Bureau Website

Go to the bureau’s dispute section and raise a dispute for the specific account.

Choose a reason like:

- Payment marked late incorrectly

- Account information incorrect

- Repayment history mismatch

Add a short description like:

“I paid EMI on time on DD/MM. It is showing as late in the report. Please correct repayment history.”

Upload your proof files.

Step 3: Raise the Same Complaint With the Lender

This step is essential. Many people only dispute on the bureau site, and then nothing happens.

Email your bank or lender and write:

- Loan or card number

- The month of wrong mark

- Proof attached

- Request for correction in bureau reporting

Ask them to update the record sent to the credit bureau.

Bolna simple hai, but follow-up is key.

Step 4: Track Dispute Status

Most bureaus give a dispute tracking number. Keep checking the status every few days.

In many cases, the bureau will mark it as:

- Under review

- Sent to the lender for verification

- Resolved or rejected

Step 5: Check Your Updated Credit Report

After dispute resolution, download a fresh credit report and verify whether the late payment has been removed or corrected.

Sometimes the status changes from late to paid on time; sometimes it becomes blank; and sometimes it remains incorrect because the lender did not update it.

If it remains wrong, you need to escalate.

What If the Dispute Gets Rejected

Rejection does not always mean you are wrong. It often means the lender did not verify properly.

Do this:

- Reopen the dispute with more substantial proof

- Call the lender’s customer support and ask for escalation

- Request written confirmation that the payment was on time

- File a complaint through the lender’s grievance email

If needed, you can also raise the issue through the banking ombudsman, but most problems are resolved before that if you keep following up.

How Long Does It Take in India

Usually:

- 7 to 15 working days for simple corrections

- Up to 30 days in some cases, depending on the lender

Your job is to stay consistent with follow-ups. Once corrected, your credit score may improve in the next update cycle.

How To Avoid This Issue in Future

- Pay EMIs 2 to 3 days before the due date

- Keep auto debit active, but still maintain a balance

- Save payment confirmations every month

- After closing any loan, collect NOC and check the report after one cycle

- Track your credit health with a trusted credit score check tool to catch errors early.

Final Thoughts

A late payment mark in error is not the end of your credit journey. But ignoring it can become costly. If you have proof, you have a strong chance of getting it fixed.

Thoda time lagta hai, but once corrected, your credit profile becomes clean again. Stay patient, stay consistent.

FAQs

How do I know if the late payment is wrong or real

Check your due date and payment date. If the payment was made on or before the due date and is still marked as late, this is incorrect.

Will disputing reduce my credit score

No. Raising a dispute does not reduce your score.

Can a lender refuse to correct wrong data?

They can delay, but not permanently, if you have proof. Escalate through grievance channels.

How many days does dispute resolution take

Most cases take 7 to 15 working days. Some can take up to 30 days.

Should I wait for a correction before applying for a loan

If you are applying for a large loan, such as a home loan, it is better to wait until the report is corrected.