UPI has become part of daily life in India. From kirana stores to fuel pumps, people use UPI for almost everything. Recently, banks introduced UPI credit cards, which allow you to pay through UPI using a credit card instead of your bank account.

This sounds convenient and attractive, but many users do not fully understand how it works, what rewards they receive, or the associated risks. Let’s break it down clearly.

What Is a UPI Credit Card?

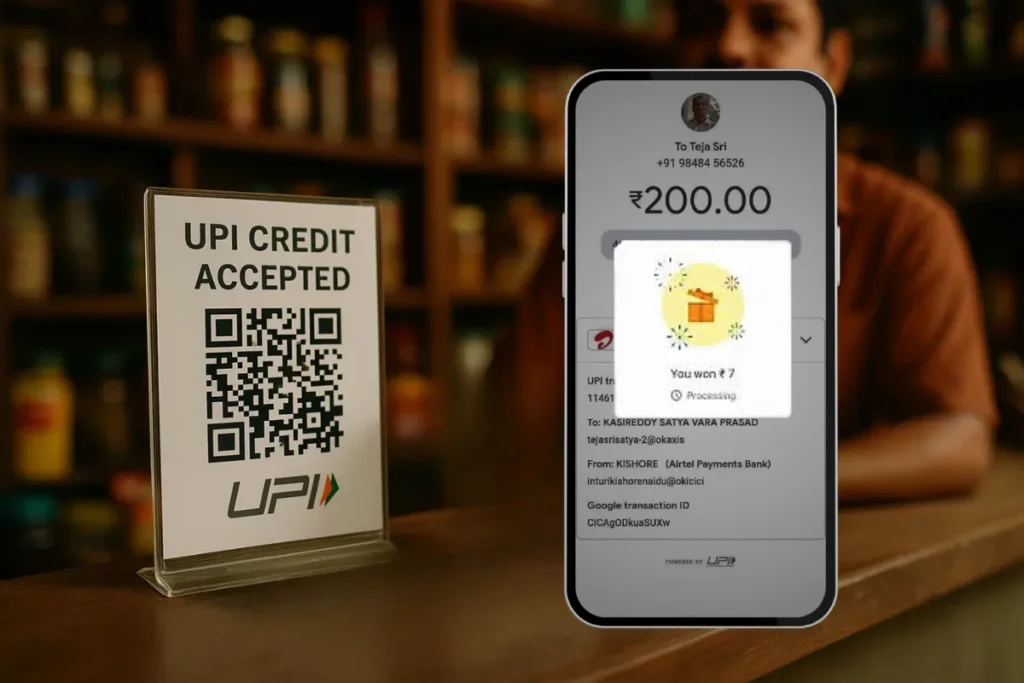

A UPI credit card allows you to make UPI payments using your credit card limit.

Instead of money getting deducted from your savings account, the amount is charged to your credit card. The transaction still appears as a standard UPI payment to the merchant.

Currently, UPI credit cards in India primarily operate on the RuPay network and are supported by popular UPI apps.

How UPI Credit Cards Work in India

The work is simple.

- You link your credit card to your UPI app

- While paying, you select a credit card as the payment option

- The amount gets added to your credit card bill

- You repay it later like a normal credit card spend

For the user, the experience feels exactly like a normal UPI payment. Scan, pay, done.

UPI ka comfort aur credit card ka power, dono ek saath.

Where Can You Use UPI Credit Cards?

UPI credit cards can be used only for merchant payments.

You can use them at

- Shops with UPI QR code

- Supermarkets

- Online merchants supporting UPI

You cannot use them for

- Sending money to friends or family

- Bank transfers

- Cash withdrawals

This restriction is intentional to prevent misuse.

Rewards on UPI Credit Card Payments

One of the biggest attractions is rewards.

Unlike regular UPI payments from a bank account, UPI credit card payments may earn

- Reward points

- Cashback

- Milestone benefits

This allows you to earn rewards even on small daily purchases, such as groceries, food, or fuel.

However, rewards depend on

- Card issuer

- Card type

- Merchant category

Not all UPI credit card payments earn high rewards. Always check your card terms.

Interest-Free Period Benefit

Just like regular credit cards, UPI credit card spends come with an interest-free period.

This typically ranges from 20 to 45 days, depending on your billing cycle.

This helps in

- Managing short-term cash flow

- Delaying payment without interest

- Better liquidity during the month

But only if you pay the whole bill on time.

Risks of Using UPI Credit Cards

Convenience always comes with risks if not managed properly.

Overspending Risk

UPI payments feel small and frequent. When combined with credit, it becomes easy to overspend without realising.

Chhoti chhoti payments milke bada bill ban jaata hai.

High Interest on Late Payment

If you do not pay the full credit card bill

- Interest rates can be very high

- Late fees apply

- Credit score gets affected

A UPI credit card is not free money.

Impact on Credit Score

All UPI credit card usage is reported to credit bureaus.

High usage or late payment can

- Increase credit utilisation

- Reduce credit score

- Affect future loan eligibility

This makes discipline very important.

Charges You Should Be Aware Of

Some users assume the UPI credit card has no charges. That is not always true.

Possible charges include

- Annual card fees

- Interest on the unpaid balance

- Late payment charges

- Cash advance charges if misused

Merchant discount charges are typically paid by merchants, not by users, but policies may vary.

Who Should Use UPI Credit Cards?

UPI credit cards are suitable for

- Disciplined credit card users

- People who pay full bills every month

- Users who want rewards for daily spending

- People tracking expenses regularly

They are not ideal for people who already struggle with credit card debt.

How to Use UPI Credit Cards Safely

Follow these simple rules

- Treat UPI credit spends like cash

- Track total monthly usage

- Keep utilisation below 30 per cent

- Pay the full bill before the due date

- Avoid converting small spends into EMIs

Regular monitoring helps you track changes in your credit score and avoid surprises.

Should You Replace Normal Credit Cards With UPI Credit Cards?

No. UPI credit cards are an addition, not a replacement. They are well-suited for small merchant payments but not for all transactions. Use each tool for its strength.

Final Thoughts

UPI credit cards combine convenience and credit, making them powerful yet risky if misused. Used wisely, they can earn rewards, improve cash flow, and help build credit history. Used carelessly, they can quietly increase debt.

The key is discipline: Thoda control rakho, aur UPI credit card ek helpful tool ban jaata hai.

FAQs

Do UPI credit card payments affect credit score?

Yes. All usage and repayments are reported like regular credit cards.

Can I send money to friends using a UPI credit card?

No. UPI credit cards work only for merchant payments.

Do all UPI credit card payments earn rewards?

Not always. Rewards depend on the card issuer and merchant category.

Is interest charged immediately on UPI credit card spends?

No, if you pay the whole bill within the interest-free period.

Should beginners use UPI credit cards?

Only if they already understand credit card discipline.