When you need extra money for renovations, education, medical expenses, or a family function, two standard options come to mind. One is a top-up on your existing home loan, and the other is a personal loan. Both are easy to access, but they differ significantly in EMI, interest, and long-term costs.

If your primary concern is which option is cheaper in India, the answer is usually clear once you understand how they work.

What Is a Home Loan Top Up?

A home loan top-up is an additional loan taken on top of your existing home loan.

Key points

- Available only if you already have a home loan

- Depends on the property value and the outstanding loan

- An interest rate is similar to a home loan

- Tenure can go up to the remaining home loan tenure

Since the loan is secured against property, lenders offer it at lower rates.

What Is a Personal Loan?

A personal loan is unsecured.

Key points

- No property or asset required

- Approval depends on income and credit score

- Interest rates are higher

- Tenure is usually shorter

Personal loans are flexible, but they come at a higher cost.

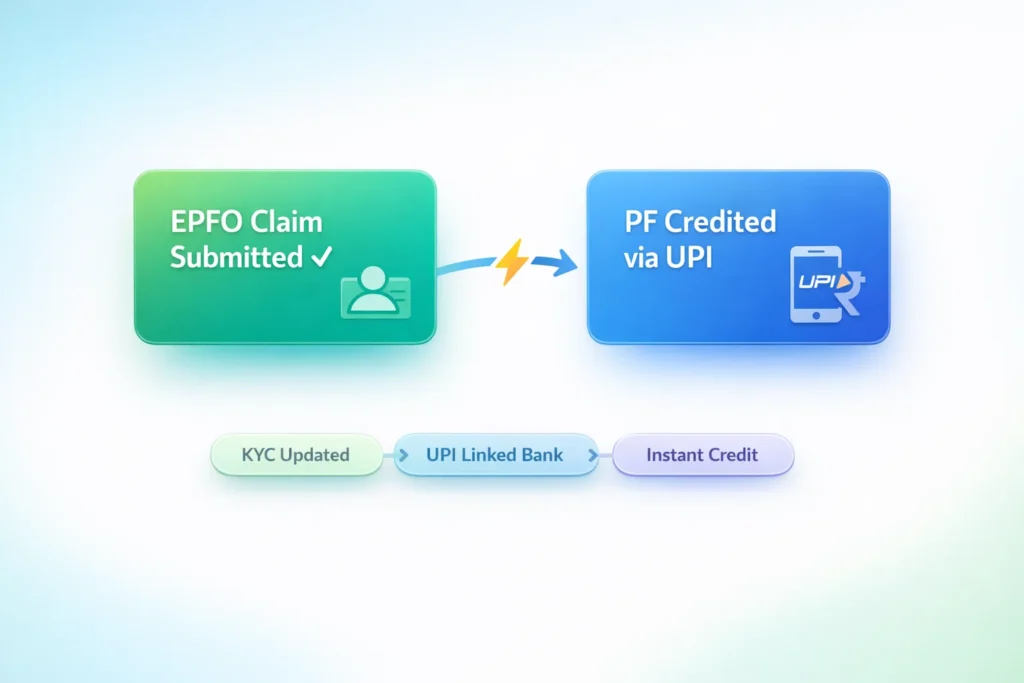

Interest Rate Comparison in India

The interest rate is the primary factor determining the EMI.

Home loan top-up

- Lower interest rate

- Close to regular home loan rates

Personal loan

- Much higher interest rate

- Varies based on credit score

Lower interest automatically means lower EMI and lower total repayment.

EMI Comparison With a Simple Example

Loan amount ₹5 lakh

Tenure 5 years

Top-up loan

- Lower interest rate

- EMI is lower

- Total interest paid is less

Personal loan

- Higher interest rate

- EMI is higher

- Total interest cost is much more

Over five years, the difference can run into tens of thousands of rupees.

Simple hai, secured loan cheaper hota hai.

Tenure Flexibility and Its Impact

Top-up loans usually allow a longer tenure.

Longer tenure

- Reduces EMI

- Increases total interest

Personal loans have shorter tenures

- Higher EMI

- Loan finishes faster

If EMI comfort is your priority, a top-up loan is a better option.

Processing Time and Ease

Personal loan

- Faster approval

- Minimal paperwork

- Suitable for urgent needs

Top-up loan

- Takes slightly longer

- Requires property-related checks

- Better for planned expenses

Urgency can sometimes justify a higher cost, but only if it is genuinely needed.

Tax Benefit Angle

Home loan top-ups may offer tax benefits only if the funds are used for home-related purposes, such as renovation or extension.

Personal loans do not offer tax benefits.

This can further reduce the effective cost of top-up loans.

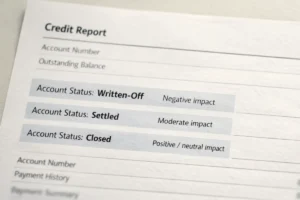

Credit Score Impact Comparison

Both loans affect your credit score in similar ways.

Positive impact if

- EMIs are paid on time

- Outstanding is managed well

Negative impact if

- EMIs are missed

- The loan amount is overstretched

Top-up loans usually have lower EMI, which reduces default risk.

Regular monitoring helps you check credit score and stay disciplined.

When Home Loan Top Up Makes Sense

A top-up loan is better if

- You already have a home loan

- You want lower EMI

- Expense is planned

- You can wait a bit for approval

It is usually the cheapest borrowing option after home loans.

When a Personal Loan Is the Better Choice

A personal loan works better if

- You need money urgently

- You do not have a home loan

- You want shorter repayment

- The amount required is small

Convenience comes at a cost, but sometimes it is acceptable.

Risks to Consider Before Choosing

Top up loan risks

- Longer debt period

- Property remains tied to the loan

Personal loan risks

- High interest burden

- EMI stress

Choose based on comfort, not just availability.

Common Mistakes Borrowers Make

- Taking a personal loan despite having a home loan

- Ignoring total interest cost

- Choosing the lowest EMI blindly

- Not checking eligibility first

Thoda calculation karna bahut paisa bacha sakta hai.

How to Decide the Right Option

Ask yourself

- Do I already have a home loan

- How urgent is the money

- What EMI can I afford comfortably

- How long do I want the loan

In most cases, a top-up on a home loan is cheaper and safer.

Final Thoughts

If you compare purely on cost, a home loan top-up is almost always cheaper than a personal loan in India. Lower interest and longer tenure make EMIs lighter and repayment smoother.

Personal loans offer speed and flexibility, but at a higher price. Choose based on urgency and affordability, not just ease. Thoda wise decision loge, to loan ka burden kaafi kam ho jaata hai.

FAQs

Is a home loan top-up cheaper than a personal loan?

Yes. Top-up loans usually have much lower interest rates.

Can I use a top-up loan for any purpose?

Yes, but tax benefits apply only for home-related use.

Does a top-up loan affect a credit score?

Yes, like any loan, but a lower EMI reduces risk.

Which loan is faster to get?

Personal loans are usually faster.

Should I take a personal loan if I already have a home loan?

Only if funds are urgently needed and a top-up is unavailable.