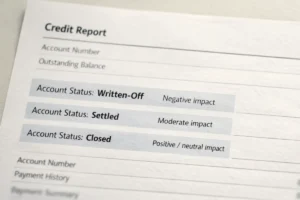

Starting your credit journey in India can be challenging if you have no credit history. Many first-time applicants, freelancers, students, or homemakers face rejection when applying for a standard credit card or loan. Banks often make it clear: no credit history means higher risk.

This is where secured credit cards come in. They are one of the safest and simplest ways to build credit from scratch in India.

What Is a Secured Credit Card?

A secured credit card is a credit card backed by a fixed deposit you keep with the bank.

The fixed deposit acts as security for the bank. Based on the FD amount, the bank gives you a credit limit.

Example

If you open a fixed deposit of ₹50,000, the bank may give you a credit limit of ₹40,000 to ₹50,000.

Your own money secures the card, but you still use it like a regular credit card.

Who Should Use a Secured Credit Card?

Secured credit cards are ideal for

- People with no credit history

- First-time salaried professionals

- Freelancers with irregular income

- Homemakers without income proof

- People with low or damaged credit scores

Agar regular credit card reject ho raha hai, secured card is the right starting point.

How Secured Credit Cards Help Build Credit

Secured credit cards work exactly like regular cards when it comes to credit reporting.

Every month

- Your card usage is reported to credit bureaus

- Your payment behaviour is tracked

- Your credit score starts getting built

If you pay your bill on time and keep usage low, your credit score improves steadily.

The key is discipline, not how much you spend.

How Much Credit Limit Do You Get?

The credit limit depends on your fixed deposit amount.

In most cases

- Credit limit is 80 to 100 per cent of the FD value

- Higher FD gives a higher credit limit

- FD stays locked until the card is active

Your FD continues to earn interest while you use the card.

Isliye paisa bhi safe, credit bhi build hota hai.

How to Use a Secured Credit Card Smartly

Using the card properly is very important.

Follow these simple rules

- Use only 20 to 30 per cent of your limit

- Pay the full bill before the due date

- Do not withdraw cash

- Avoid converting everything into EMI

- Keep the card active with small monthly spends

Small, regular spending is better than big, occasional spending.

How Long Does It Take to Build a Credit Score?

Most users see a credit score generated within 3 to 6 months.

By 6 to 12 months of clean usage

- Credit score improves

- You become eligible for unsecured cards

- Loan approvals become easier

Consistency matters more than speed.

Can You Upgrade to a Regular Credit Card?

Yes.

Once your credit history improves, banks may offer

- Credit limit increase

- Conversion to an unsecured card

- New credit cards without FD

Some banks automatically review your profile after 6 to 12 months.

Tab secured card se regular card ka journey smooth ho jaata hai.

Common Mistakes to Avoid

Many people misuse secured cards, thinking there is no risk.

Avoid these mistakes

- Maxing out the credit limit

- Paying only the minimum due

- Missing due dates

- Closing the card too early

- Using FD money for other needs

Remember, even though the card is secured, late payments still damage your credit score.

Should You Close the Secured Card Later?

Not immediately.

Once you get a regular card

- Keep the secured card active for some time

- Maintain low usage

- Close only when you no longer need it

Closing old accounts too quickly can shorten the credit history.

Why Secured Credit Cards Are Better Than Other Options

Compared to informal credit or risky apps, secured cards are safer.

They

- Build a proper credit history

- Banks regulate them

- Do not trap you with hidden charges

- Improve long-term financial access

This makes them one of the best tools to check credit score improvement over time and move ahead confidently.

Final Thoughts

Secured credit cards are not a backup option. They are a smart first step for anyone starting their credit journey in India.

When used responsibly, they open doors to better loans, better cards, and greater financial freedom. Thoda patience rakho, result zaroor milega.

FAQs

Do secured credit cards build a credit score?

Yes. They are reported like regular credit cards.

Is the fixed deposit money blocked?

Yes, FD remains locked while the card is active.

Can I lose my FD money?

Only if you do not pay the dues; otherwise, your funds remain secure.

How soon can I get an unsecured card?

Usually, after 6 to 12 months of good usage.

Is a secured card better than taking small loans?

Yes. It is safer and more controlled for credit building.