If you have ever received a message stating that your EMI auto-debit failed, it can be stressful. NACH or ECS mandate failures are common in India and can occur even when funds are available in your bank account. Many people panic because they worry about penalties and damage to their credit scores.

The good news is most mandate failures are easy to fix if you act quickly. Let’s understand why these failures happen and what you should do immediately.

What Is NACH or ECS Mandate?

NACH and ECS are systems used by banks to debit EMIs from your bank account automatically.

They are used for

- Home loan EMIs

- Car loan EMIs

- Personal loan EMIs

- Insurance premiums

- SIPs and recurring payments

Once you sign the mandate, the bank debits the EMI automatically every month.

What Does Mandate Failure Mean?

Mandate failure occurs when the bank attempts to debit your EMI, but the transaction does not go through.

This does not always mean you did something wrong. Sometimes it is a system or bank issue.

But if not handled on time, it can lead to

- Late payment charges

- Penalty interest

- Negative credit report entry

Isliye delay ignore karna risky hota hai.

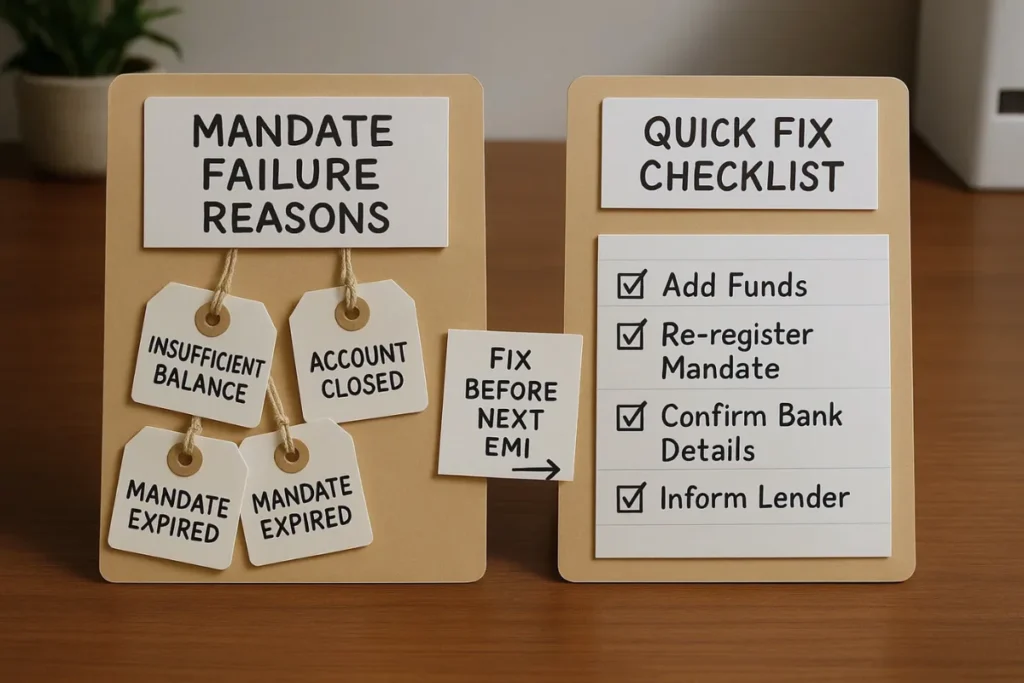

Common Reasons for NACH or ECS Mandate Failure

Insufficient Balance

This is the most common reason.

If your account balance is lower than the EMI amount on the debit date, the mandate fails.

Bank Holiday or Technical Issue

Sometimes, debits fail due to

- Bank server problems

- Scheduled maintenance

- National or local bank holidays

These are temporary issues, but still count as failed attempts.

Mandate Expired or Cancelled

Mandates have validity periods.

If

- Mandate expired

- Account was changed

- Bank details were updated

The debit may fail.

Signature or Account Mismatch

Old mandates sometimes fail if

- Signature does not match bank records

- Account type changed

- KYC updated recently

Change in EMI Amount

If EMI increased due to an interest rate change and the mandate limit was lower, the debit may fail.

Ye point kaafi log miss kar dete hain.

Immediate Steps to Take After Mandate Failure

Step 1: Do Not Wait

As soon as you get the failure message, act. Same-day action reduces damage.

Step 2: Pay EMI Manually

Use net banking, UPI, or a bank branch to pay the EMI immediately.

Manual payment helps prevent default even if auto-debit fails.

Step 3: Inform the Lender

Call or email the lender and inform them that

- Mandate failed

- Payment has been made manually

Ask them to update records properly.

Step 4: Check for Penalty

Some lenders automatically add a penalty.

Request reversal if failure was due to a technical or bank issue, and the payment was done quickly.

Quick Fix Checklist to Prevent Future Failures

Use this checklist to avoid repeat issues.

- Keep an extra balance before the EMI date.

- Align EMI date with salary credit.

- Track interest rate changes

- Check the mandate expiry date

- Update bank details if the account changes

- Avoid closing the linked bank account

- Enable SMS and email alerts

Small steps save big trouble later.

Does Mandate Failure Affect Credit Score?

Yes, it can.

If EMI is marked unpaid or late

- It can reflect as a late payment

- Your credit score may drop

- Future loan approvals get affected

If you pay manually on the same day and the lender updates the records correctly, the credit score impact can be avoided.

Regular monitoring helps you detect changes in your credit score early and take action.

How Many Times Can Mandate Fail?

There is no fixed limit, but repeated failures create risk.

- Lenders may stop auto debit

- Manual payment may be required

- The account may be flagged internally

Multiple failures also show poor payment discipline to banks.

Should You Change Mandate or Bank Account?

Change the mandate if

- Your salary account changed

- The old account has a low balance

- The mandate limit is too low

Updating the mandate once is better than repeatedly failing.

NACH vs ECS: Is There Any Difference for You?

From a user’s point of view

- Both work similarly

- Both are auto debit systems

- Both failures affect EMI in the same way

The fix process is the same.

Common Mistakes People Make

- Waiting for next month to pay

- Assuming auto debit will retry

- Ignoring penalty messages

- Not informing the lender after a manual payment

- Not checking the credit report later

Yeh chhoti mistakes credit score ko quietly damage kar sakti hain.

Final Thoughts

NACH or ECS mandate failures are common in India and are usually not a significant issue if addressed promptly. The real problem starts when people ignore it or delay action.

Pay manually, inform the lender, fix the root cause, and move on. Thoda alert rehne se credit score safe rehta hai, and EMI stress kam hota hai.

FAQs

Does mandate failure always mean late payment?

No. If you pay manually on time, it may not be treated as late.

Can technical issues at the bank cause mandate failure?

Yes. Server issues and holidays can cause failures.

Will a mandate failure reduce my credit score?

Only if EMI remains unpaid or the lender reports it as late.

How soon should I pay after mandate failure?

Ideally, on the same day or within one working day.

Can I change the EMI debit date?

Yes. Many lenders allow date changes based on the salary cycle.