Credit cards can be handy when handled wisely. They help you manage monthly expenses, improve your credit score, and earn rewards on everyday spending. But if used carelessly, they can lead to debt and financial stress. The goal is simple. Use the card for benefits, not for burden.

Here is a practical guide for Indian users on how to enjoy rewards without falling into debt.

Know Your Credit Card Benefits

Every credit card comes with different features. Some offer cashback, others travel rewards, and others discounts on fuel, dining, or shopping. Before using your card regularly, check the rewards it offers on daily spend categories like groceries, online shopping, or bills. When you use the card that provides the most value, your rewards add up quickly.

Pay the Full Bill Every Month

This is the most important rule. Always pay the complete outstanding amount before the due date. Paying only the minimum amount leads to heavy interest charges. These charges can proliferate and put you into debt. Full payment keeps you worry-free and also protects your credit score.

Keep Your Credit Usage Low

Try to use only a small portion of your total credit limit. Most experts suggest staying below 30 percent. For example, if your limit is 1 lakh, try not to spend beyond 30 thousand on your card each month. Low usage shows banks that you are responsible and improves your credit score over time.

Use the Card for Planned Spending

Credit cards are best used for planned expenses, such as groceries, fuel, bills, subscriptions, and online payments. Avoid using the card for sudden big purchases unless you know you can pay the bill on time. Planned spending helps you track expenses better and prevents surprises at the end of the month.

Track Your Billing Cycle

Every card has a fixed billing cycle. By timing your purchases around your cycle, you can make them more effective. For example, if your bill is generated on the 10th, buying something on the 11th gives you almost a whole month before payment is due. This helps you enjoy the interest-free period fully and manage cash flow better.

Redeem Rewards and Benefits

Credit card rewards are valuable only if you actually use them. Keep checking your reward balance and redeem it for vouchers, cashback, or bill payments. Many users forget to claim their points, which can result in them losing benefits. Make it a habit to check every few months.

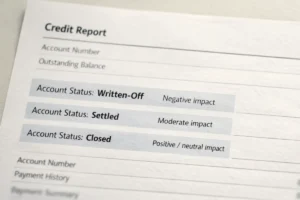

Avoid Multiple Loan and Card Applications

Applying for too many cards or loans within a short time creates multiple enquiries on your credit report. This can lower your credit score and make you look credit hungry. Apply only when you really need a card or when the rewards match your lifestyle.

Track Your Credit Score Regularly

Using a credit card responsibly is one of the fastest ways to build a strong credit score. Track your score regularly to understand how your spending and payments affect your credit health. You can use a check credit score platform to stay updated.

Stay Organised

Set reminders for bill payments. Keep a slight note of your monthly spending. Review your card statement for errors. These small steps help you avoid unnecessary charges and maintain control over your finances.

Innovative credit card use is not about spending less. It is about spending with awareness and paying responsibly. Bas itna yaad rakho. Credit card sahi tarah se use karoge to rewards bhi milenge aur stress bhi nahi hoga. Payment time par karo, limit wisely use karo, aur financial life smooth rahegi.