Paying EMIs every month can feel stressful when you have many loans together. Home loan, car loan, credit card bill, or personal loan — sab ek saath aa jate hain. The good news is, you can still save money on EMIs and live comfortably. All it takes is a few simple money habits and some planning.

Why EMIs Feel Heavy

For most salaried people in India, a large portion of their salary goes toward EMIs. High interest rates, extended loan periods, and small loans taken repeatedly make the burden heavier. If you miss even one payment, penalty lagta hai, and your credit score can drop.

Combine Your Loans

If you have many small loans or credit card balances, combine them into a single larger loan with a lower rate. This is called loan consolidation. It makes repayment easy and often cheaper. Some banks also give balance transfer options so you can move your loan to a better plan.

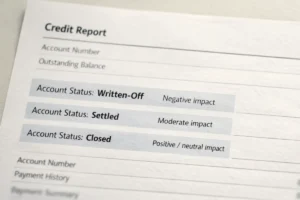

Refinance for Lower Rates

If your credit score has improved, ask your bank for a lower interest rate or shift to another bank that offers a better deal. Even a 1 percent lower rate can help you save a good amount.

Before applying, check your score on a credit-building platform. A good score means banks will trust you more and give better terms.

Increase EMI When You Get a Raise

When your salary increases, you can raise your EMI a little. Paying a bit more each month helps you finish the loan faster and pay less interest overall. It is one of the simplest ways to save money without cutting back on your lifestyle.

Pay On Time

Late EMI payments mean extra charges and a lower credit score. Set up auto-debit so your EMIs are paid on time. You will never miss a payment and avoid penalties.

Pick the Right Loan Period

An extended loan period means small EMIs but higher total interest. A short period means higher EMIs but lower total payments. Choose what suits your income and savings.

Use Credit Cards Wisely

Pay your full bill each month. Avoid the “minimum payment” trap because it attracts very high interest. Use credit cards that give cashback or reward points on regular spends like groceries and fuel, so you get something back.

Keep Your Credit Score Healthy

Banks offer better rates when your score is high. Pay bills on time, use less than 30 percent of your credit limit, and avoid applying for too many loans at once.

Saving on EMIs is not about cutting your lifestyle; it is about managing your money smartly. Plan, pay on time, and use your credit wisely.

Bas itna samajh lo — thoda smart planning se EMI ka bojh kam hota hai aur life bhi easy rehti hai. Time par payment karo, score strong rakho, aur paisa bachao bina stress ke.