When you need money urgently in India, two standard options quickly come to mind. One is a gold loan, and the other is a personal loan. Both are easy to access, but they work very differently with respect to EMI, interest costs, and long-term impact.

If your main question is which option offers the lower EMI, the answer depends on a few practical factors. Let’s compare both clearly.

What Is a Gold Loan?

A gold loan is a loan in which you pledge your gold jewellery as collateral.

Key points

- Loan amount depends on the gold value

- Interest rates are usually lower

- Processing is fast

- Gold stays with the lender till repayment

Because gold is held as collateral, lenders perceive lower risk.

What Is a Personal Loan?

A personal loan is unsecured. You do not need to give any asset as security.

Key points

- Loan depends on income and credit score

- Interest rates are higher

- Approval takes longer than a gold loan

- No asset is pledged

Banks take more risk here, so the cost is higher.

Interest Rate Comparison in India

The interest rate is the primary factor determining the EMI.

Gold loan

- Interest rates are usually lower

- Rates vary based on the lender and tenure

Personal loan

- Interest rates are higher

- The rate depends heavily on the credit score

Lower interest directly means lower EMI.

EMI Comparison With a Simple Example

Loan amount: ₹3 lakh; Tenure: 3 years.

Gold loan

- Lower interest rate

- EMI is comparatively lower

Personal loan

- Higher interest rate

- EMI is higher for the same amount

Over the whole tenure, a personal loan costs much more in interest.

Simple hai; secured loans are usually cheaper.

Why Gold Loan EMI Is Usually Cheaper

Gold loans are cheaper mainly because

- Gold reduces lender risk

- Recovery is easier for the lender

- Interest rates are controlled

As a result, lenders pass the benefit to borrowers through lower EMI.

When Personal Loan EMI Becomes Costly

Personal loan EMI increases due to

- Higher interest rate

- Longer tenure

- Lower credit score

If your credit score is average or low, EMI becomes even heavier.

Other Costs You Should Consider

EMI is not the only cost.

Gold loan extra points

- Storage and valuation charges may apply

- Risk of gold auction if EMIs are missed

Personal loan extra points

- Higher processing fees

- Penalty for late payment

- A substantial credit score has an impact on default

A gold loan may seem cheaper, but the risk of losing the gold is real.

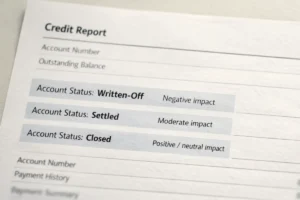

Credit Score Impact Comparison

Gold loan

- Missed EMIs can affect your credit score

- Default may lead to a gold auction

- Impact may be slightly lower than a personal loan

Personal loan

- Missed EMIs hurt your credit score badly

- Defaults stay longer in a credit report

- Future loan eligibility reduces

If you care about long-term credit health, repayment discipline matters more than loan type.

When Gold Loan Makes More Sense

A gold loan is better if

- You already have gold at home

- You want lower EMI

- You need money quickly

- You are confident of repayment

India mein gold almost har ghar mein hota hai, which makes this option practical.

When a Personal Loan Is a Better Option

A personal loan works better if

- You do not want to risk gold

- The loan amount is higher

- You want a longer tenure

- You have a strong credit score

Comfort and emotional factors also matter.

How to Decide the Right Option

Ask yourself

- Can I risk my gold if something goes wrong

- How urgent is the money

- What EMI can I comfortably pay

- How strong is my credit score

Before making a decision, always check your credit score to understand where you stand.

Common Mistakes Borrowers Make

- Choosing lower EMI without understanding risk

- Taking a personal loan despite having gold

- Stretching tenure to reduce EMI

- Ignoring the impact of missed payments

Thoda planning kar loge, to stress kam hoga.

Final Thoughts

If we look only at EMI, gold loans are usually cheaper than personal loans in India. But cheaper EMI comes with the responsibility of safeguarding your gold through timely repayment.

Personal loans cost more, but they offer psychological comfort because no collateral is pledged. The right choice depends on your financial stability, urgency, and risk appetite.

Sasta hamesha better nahi hota, safe hona bhi zaroori hai.

FAQs

Is a gold loan cheaper than a personal loan?

Yes. Gold loans usually have lower interest and lower EMI.

Does a gold loan affect a credit score?

Yes. Missed EMIs are reported and can affect your score.

Can my gold be auctioned if I miss payments?

Yes, if defaults continue for long.

Which loan is faster to get?

Gold loans are usually faster.

Should I choose a loan only based on EMI?

No. Always consider risk, tenure, and repayment comfort.