Your 20s and 30s are the most critical years for building a strong financial base. This is the stage when your first salary arrives, expenses start to increase, and long-term goals slowly take shape. If you get your money habits right now, life becomes easier later, with fewer loans, fewer worries, and more freedom to choose what you want.

Here’s a simple financial checklist for Indian millennials and young professionals who want stability without feeling restricted.

Build a Basic Budget

Start by understanding where your money goes each month. Rent, food, travel, EMIs, mobile bills, outings, everything adds up. A basic monthly budget keeps you aware and stops those “salary kahaan gayi?” moments. You don’t need complicated tools. A simple phone note or an app is enough.

Create an Emergency Fund

Life is unpredictable. Medical emergencies, sudden repairs, family needs, or job shifts can happen at any time. Aim to save at least 3 to 6 months of expenses in a separate account. This gives you peace of mind and stops you from using credit cards or taking loans in stressful moments.

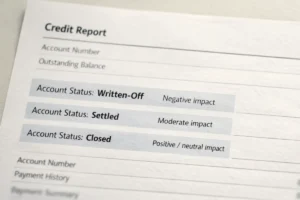

Build and Track Your Credit Score

Your credit score decides whether you’ll get a loan easily in the future. Want a home loan later? Want a car? Need a credit card upgrade? All of this depends on your credit behaviour today.

- Pay EMIs and card bills on time.

- Keep credit card usage below 30 percent.

- Avoid applying for too many loans.

You can monitor your credit health anytime through a check credit score platform to stay aware of your progress.

Start Small Investments Early

You don’t need lakhs to start investing. Even 500 to 1000 rupees a month can grow over the years.

Popular choices for young Indians include:

- SIPs in mutual funds

- Recurring deposits

- NPS for retirement

- Gold savings or digital gold

Starting early gives your money more time to grow. Compounding is your friend; the earlier you begin, the better the results.

Get the Right Insurance

Insurance is not an extra cost. It protects your savings.

- Term insurance if you have dependents.

- Health insurance for medical safety. Even a basic plan saves you from having to use your credit card or take personal loans in emergencies.

Avoid Lifestyle Debt

It’s tempting to buy the latest phone, upgrade gadgets, or splurge during sales. But don’t use loans or credit cards for things that don’t add long-term value.

If you do use a card, pay the whole bill every month: no rolling balance, no interest, no stress.

Plan for Long-Term Goals

Your 20s and 30s are when goals slowly become real, planning a house, marriage, travel, or even starting a business later. Save a small amount regularly for these milestones. When the time comes, you won’t feel pressured.

Keep Learning About Money

Financial mistakes happen when you don’t understand how money works. Spend a little time each month reading about credit scores, budgeting, loans, and basic investing. The more you learn, the easier your decisions become.

A solid financial foundation is built step by step. Nothing changes overnight, but consistent habits always win.

Bas itna yaad rakho: thoda saving, thoda investing, aur credit score strong. Aise hi 20s aur 30s financially sorted ho jate hain.