Debit card EMI have become popular in India, especially for online shopping and large purchases such as electronics, appliances, and mobile phones. Many people prefer it because it does not require a credit card. But debit card EMI is often misunderstood. While it looks simple, it comes with conditions, limits, and costs that users should clearly understand.

Let’s break down how debit card EMI works in India and whether it really makes sense.

What Is Debit Card EMI?

Debit card EMI lets you convert a purchase into monthly instalments, which are debited directly from your bank account.

Unlike credit cards

- There is no credit limit

- EMIs are deducted from your savings account

- Approval depends on your bank relationship

This option is available primarily during online checkout or at select offline stores.

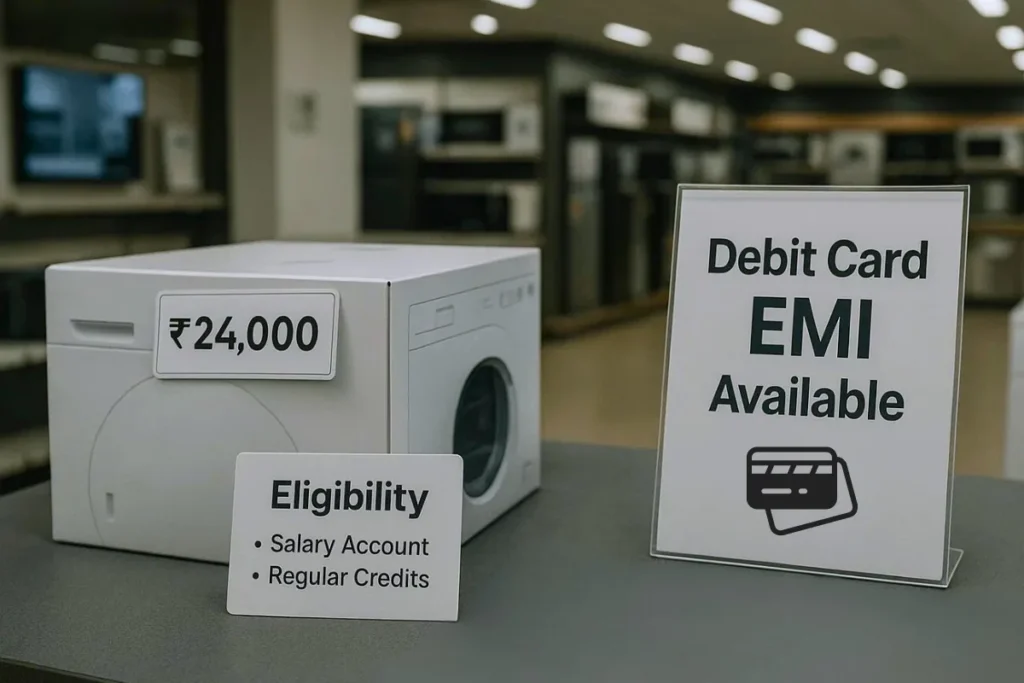

Who Is Eligible for Debit Card EMI in India?

Debit card EMI is not available to everyone.

Eligibility usually depends on

- Your bank

- Account vintage

- Average balance maintained

- Past transaction history

Banks prefer customers with

- Regular salary credits

- Stable account usage

- Clean banking record

Even if you have a debit card, the EMI option may not show if you do not meet internal criteria.

Sabke liye available nahi hota, yeh samajhna zaroori hai.

Do You Need a Credit Score for Debit Card EMI?

In most cases, debit card EMI does not depend heavily on credit score.

Banks look more at

- Your bank account behaviour

- Past EMI repayment, if any

- Overall relationship value

However, missed EMIs can still affect your credit profile if the bank reports it.

Debit Card EMI Limits Explained

Debit card EMI limits are usually lower than credit card limits.

Limits depend on

- Bank policies

- Account balance history

- Salary or income pattern

Typical limits range from ₹10,000 to ₹2,00,000 depending on the bank and customer profile.

The limit is dynamic and can change over time.

How Debit Card EMI Is Repaid

Debit card EMI are processed via auto-debit.

- The EMI amount is fixed.

- The amount gets debited every month

- Tenure usually ranges from 3 to 12 months

If there is insufficient balance on the EMI date, the payment can fail.

Isliye balance maintain karna bahut important hai.

Real Costs of Debit Card EMI

Many people assume debit card EMI is free. That is not always true.

Possible costs include

- Interest charges depend on the offer

- Processing fees

- GST on interest and fees

- Late payment penalties

Some offers advertise no-cost EMI, but interest may be adjusted through discounts.

Always check the final payable amount before confirming.

No Cost Debit Card EMI Reality

No cost EMI does not mean zero cost.

In many cases

- Interest is charged but adjusted through an upfront discount

- If you cancel or return the product, the discount may be reversed

- GST on interest may still apply

So the cost advantage depends on how the offer is structured.

Debit Card EMI vs Credit Card EMI

Debit card EMI

- No credit card required

- Lower limits

- Direct debit from a bank account

Credit card EMI

- Higher limits

- Better flexibility

- Clear interest-free period

From a credit score perspective, credit cards are easier to manage over the long term.

Impact of Debit Card EMI on Credit Score

This depends on whether the bank reports the EMI to credit bureaus.

Possible outcomes

- On-time payment may help credit history

- Missed EMI can hurt your credit score

- Multiple EMIs increase financial stress

If reported, debit card EMI behaves like any other loan.

It is always safer to assume it will affect your credit, and to pay on time.

When Debit Card EMI Makes Sense

Debit card EMI is applicable if

- You do not have a credit card

- The purchase amount is moderate

- You have a steady bank balance

- Tenure is short

It works well for disciplined users.

When You Should Avoid Debit Card EMI

Avoid debit card EMI if

- Your bank balance fluctuates

- You already have multiple EMIs

- You rely on a minimum balance

- You are unsure about the monthly cash flow

One missed debit can create unnecessary stress.

How to Use Debit Card EMI Safely

Follow these simple steps

- Keep an extra balance before the EMI date

- Avoid stacking multiple EMIs

- Read the offer terms carefully

- Track EMIs regularly

- Periodically check your credit score to ensure no adverse impact

Debit card EMI is convenient, but discipline is key.

Final Thoughts

Debit card EMI are a valuable option for Indians who do not use credit cards, but it is not free money. Limits are lower, costs can exist, and missed payments can cause problems.

Before choosing debit card EMI, understand the real cost and your ability to repay comfortably. Thoda planning aur awareness se yeh option kaafi useful ho sakta hai.

FAQs

Is debit card EMI available on all debit cards?

No. It depends on the bank and customer eligibility.

Does debit card EMI affect credit score?

It may, especially if EMIs are reported or payments are missed.

Is debit card EMI cheaper than credit card EMI?

Not always. Credit cards can be cheaper if bills are paid on time.

What happens if debit card EMI fails?

Late fees may apply and may affect your banking record.

Can I prepay debit card EMI?

Some banks allow it, but prepayment terms vary.