The credit utilisation ratio is one of the most misunderstood components of a credit score in India. Many people pay their EMIs and credit card bills on time, but still see their credit scores stuck or declining. In most cases, high credit utilisation is the reason.

This article explains what the credit utilisation ratio is, how it works in India, and how you can manage it easily with real examples.

What Is Credit Utilisation Ratio?

The credit utilisation ratio shows how much credit you are using compared to your total available credit.

It is mainly calculated using credit cards and overdraft limits.

Example

If your credit card limit is ₹1,00,000 and you use ₹40,000, your credit utilisation is 40%.

Lower utilisation shows better money management. Higher utilisation signals risk to lenders.

Why Credit Utilisation Matters in India

Banks and lenders in India closely track how much of your credit limit you use.

High utilisation tells lenders

- You may be dependent on credit

- You have less of a financial buffer

- You may struggle during emergencies

Even if you pay bills on time, regularly exceeding your credit limit can hurt your credit score.

Yehi jagah pe kaafi log galti kar dete hain.

What Is a Good Credit Utilisation Ratio?

In India, most lenders prefer a credit utilisation below 30 per cent.

Here is a simple range

- Below 30 per cent is excellent

- 30 to 50 per cent is manageable

- Above 50 per cent starts hurting your score

- Nearly 100 per cent is risky

This applies to each card and to overall usage.

Simple Credit Utilisation Examples

Example 1: Single Credit Card

Credit limit ₹50,000

Monthly usage ₹15,000

Utilisation

15,000 ÷ 50,000 = 30 percent

This is healthy and safe.

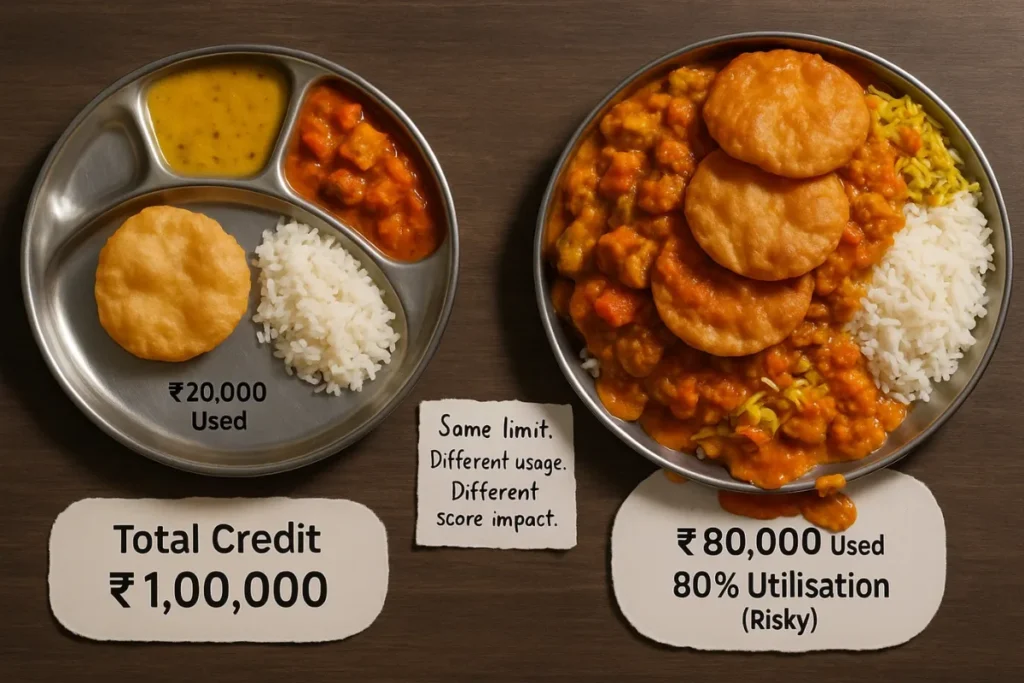

Example 2: High Usage Card

Credit limit ₹1,00,000

Monthly usage ₹80,000

Utilisation

80 percent

Even if you pay the full amount each month, it can still reduce your credit score.

Example 3: Multiple Credit Cards

Card 1 limit ₹50,000 usage ₹10,000

Card 2 limit ₹50,000 usage ₹25,000

Total limit ₹1,00,000

Total usage ₹35,000

Overall utilisation 35 per cent

Still slightly high, but better than maxing out one card.

Does Credit Utilisation Reset After Payment?

Yes, but timing matters.

Credit bureaus usually record your balance as on the statement date, not the payment date.

If your statement shows high usage, it gets reported even if you pay the bill the next day.

Isliye bill date samajhna bahut zaroori hai.

How Credit Utilisation Affects Loan Approval

For personal loans, car loans, and even home loans, lenders look at

- Your credit score

- Your recent utilisation behaviour

High utilisation can lead to

- Loan rejection

- Higher interest rate

- Lower approved amount

Lenders prefer borrowers who use credit lightly rather than heavily.

Common Credit Utilisation Mistakes in India

- Using the full limit every month

- Paying only the minimum due

- Having low limits and high spending

- Using one card heavily and ignoring others

- Not knowing the statement date

These mistakes are common among salaried professionals and first-time card users.

How to Reduce Credit Utilisation Safely

You can reduce utilisation without stopping card usage.

Practical steps

- Pay part of the bill before the statement date

- Spread spending across cards

- Request a credit limit increase

- Avoid large purchases close to the statement date

- Keep one card as a backup and unused

If done correctly, score improvement can be seen in 1 to 2 months.

Should You Close Credit Cards to Reduce Utilisation?

Usually, no.

Closing cards reduces total available credit, which can increase the utilisation ratio.

It is better to keep old cards active with low usage, especially if they have high limits.

How Often Should You Check Credit Utilisation?

You should track it at least once every month.

Regular monitoring helps you track changes in your credit score early and address issues before applying for loans.

Final Thoughts

Credit utilisation ratio is simple math, but its impact is powerful.

You do not need to stop using credit cards. You only need to use them smartly. Thoda planning, thoda awareness, and your credit profile stays strong.

A healthy utilisation ratio today makes future loans easier and cheaper.

FAQs

What is the ideal credit utilisation ratio in India?

A score below 30 per cent is considered ideal by most lenders.

Does paying the full credit card bill remove the utilisation impact?

It helps, but the balance on the statement date still matters.

Does utilisation matter for people with high incomes?

Yes. Utilisation is judged against the limit, not income.

How fast does a credit score improve after lowering utilisation?

Usually within 30 to 60 days.

Is utilisation calculated separately for each card?

Yes. Both individual card usage and total usage are considered.