Buying a house is one of the most significant financial decisions for Indians. Parents often say buying is always better, while younger professionals feel renting offers greater flexibility. Both sides have strong opinions, but the right decision depends on numbers, not emotions.

Instead of debates, let’s look at practical math that helps you decide whether renting or buying makes sense for you today.

Why Rent vs Buy Is Not a One-Size-Fits-All Decision

In India, factors such as city, income stability, job location, family plans, and property prices vary widely.

Buying is not always good. Renting is not always bad.

The correct choice depends on

- Monthly cash flow

- Property price and loan amount

- How long do you plan to stay

- Opportunity cost of money

Let’s break it down step by step.

The Real Cost of Buying a Home in India

Most people focus only on EMI, but buying entails many costs.

Upfront Costs

- A down payment is usually 15 to 25 per cent

- Stamp duty and registration

- Brokerage and legal charges

Example

Property price ₹80 lakh

Down payment 20 per cent ₹16 lakh

Extra costs of around ₹5 to 6 lakh

Total upfront money close to ₹22 lakh.

Monthly Costs

- Home loan EMI

- Maintenance charges

- Property tax

- Repairs and upgrades

EMI is just one part of the total cost.

The Real Cost of Renting a Home

Renting may seem simple, but it still incurs costs.

- Monthly rent

- Annual rent increase

- Security deposit

- Occasional moving expenses

Example

Monthly rent ₹30,000

Annual rent around ₹3.6 lakh

Over 10 years, rent paid becomes ₹36 lakh, ignoring increases.

But the key difference is that you do not block a large amount up front.

Simple Rent vs Buy Math Example

Let’s compare two scenarios.

Buying Scenario

Property price ₹80 lakh

Loan ₹64 lakh

EMI approx ₹55,000

Loan tenure 20 years

Total EMI paid over 20 years can cross ₹1.3 crore.

Renting Scenario

Rent ₹30,000

Yearly increase by 5 per cent

Total rent paid over 20 years may be around ₹95 lakh.

On paper, buying looks expensive, but you own a house at the end. Renting appears cheaper, but there is no ownership.

Yahin pe real thinking start hoti hai.

Opportunity Cost of Down Payment

This is the most ignored factor.

That ₹20-22 lakh down payment could be invested.

If invested at even a 10 per cent annual return, it can grow significantly over time.

Instead of locking money in a house, investing gives flexibility and liquidity.

Buying makes sense only if property appreciation plus emotional value beats investment returns.

When Buying a Home Makes Sense

Buying usually works better if

- You plan to stay in the same city for a long time

- Your income is stable

- EMI is below 35 to 40 per cent of income

- You already have emergency savings

- You value ownership and stability

Buying is not just financial. Emotional comfort also matters.

When Renting Is the Smarter Choice

Renting is often better if

- You change jobs or cities often

- Property prices are very high

- EMI is much higher than the rent

- You want financial flexibility

- You are building investments first

Renting gives freedom and lower risk.

Aaj kal ka job market dekh ke, flexibility bhi important hai.

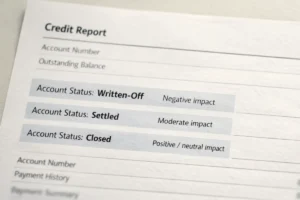

Credit Score and Loan Angle

Buying a home means long-term EMIs.

If your credit score is not strong

- Interest rates may be higher

- EMI burden increases

- Loan approval becomes tougher

Before deciding to buy, it is essential to check your credit score and understand how much of a loan you can comfortably qualify for.

Emotional vs Financial Balance

In India, owning a home is linked to security and social comfort.

There is nothing wrong with buying for emotional reasons, but do not stretch finances just because of pressure.

A stressed homeowner is worse than a peaceful renter.

A Simple Rule to Decide

Ask yourself

- Is EMI more than 1.5 times the rent

- Can I stay here for 8 to 10 years

- Do I have savings after the down payment

- Will my lifestyle suffer after buying

If most answers are yes, buying may make sense. Otherwise, renting is not a failure.

Final Thoughts

Rent vs buy is not about right or wrong. It is about timing and numbers.

Renting builds flexibility. Buying builds stability. Both are valid choices at different life stages.

Decide based on math, not pressure. Thoda calculation karo, decision apne aap clear ho jaata hai.

FAQs

Is renting a waste of money in India?

No. Rent provides flexibility and reduces financial risk.

Is buying always better in the long run?

Not always. High prices and interest can make buying expensive.

How much EMI is safe compared to income?

Usually below 35 to 40 per cent of the monthly income.

Should I wait for property prices to fall?

Timing the market is challenging. Buy only when financially ready.

Does renting affect credit score?

No. Renting does not affect your credit score.