When you take out a home loan, car loan, or personal loan, the bank provides an amortisation schedule. Most people ignore it because it looks complicated. Big table, many numbers, and small fonts. But this one document can help you save lakhs if you understand it correctly.

An amortisation schedule shows how your EMI is split between interest and principal over time. Once you know how to read it, planning prepayments becomes much easier.

What Is an Amortisation Schedule?

An amortisation schedule is a month-wise breakup of your loan.

It shows

- EMI amount

- Interest paid each month

- Principal repaid each month

- Outstanding loan balance after every EMI

This schedule covers your full loan tenure, from the first EMI to the last.

Why Amortisation Schedule Matters in India

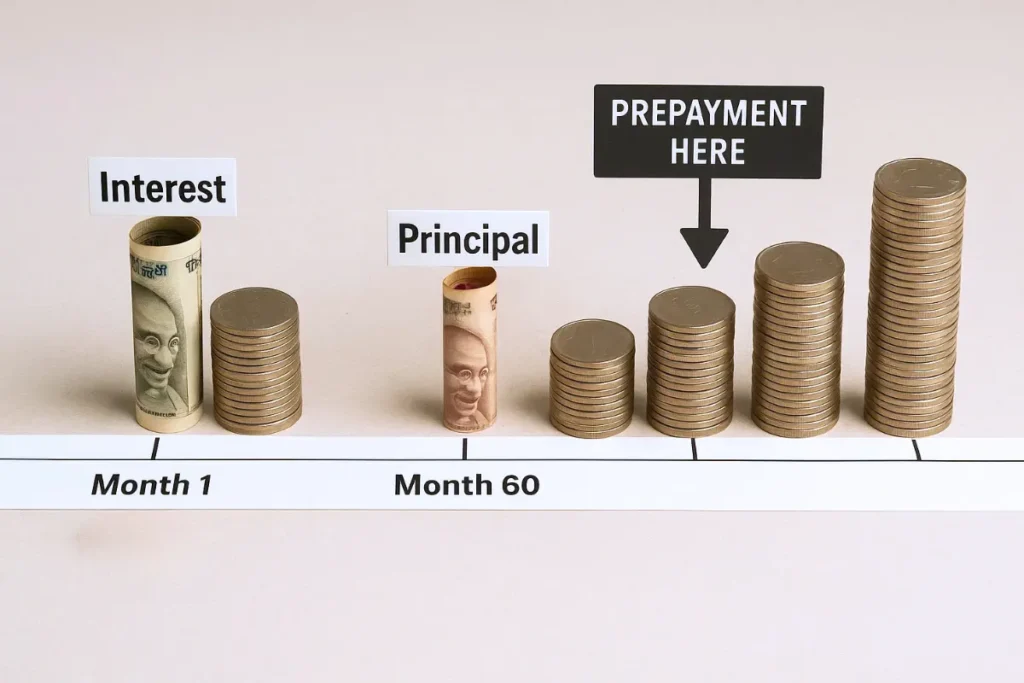

Indian loans are usually long-term, especially home loans. In the early years, most of your EMI goes towards interest, not principal.

If you do not understand this, you may think regular EMIs are enough. In reality, smart prepayments at the right time can significantly reduce interest.

Yahin pe log galti karte hain aur extra interest de dete hain.

How to Read an Amortisation Schedule Step by Step

Step 1: Look at the EMI Amount

EMI usually stays the same for fixed-rate loans. For floating rate loans, EMI or tenure may change.

Step 2: Check Interest Component

In the first few years, interest makes up a large share of EMI.

Example

EMI ₹40,000

Interest ₹32,000

Principal ₹8,000

This means you are paying most of the interest early.

Step 3: Track Principal Reduction

As months pass, interest reduces, and the principal portion increases.

By mid-tenure, the split becomes more balanced. Towards the end, most of the EMI goes to the principal.

Step 4: Observe Outstanding Balance

This shows how slowly the loan reduces in the early years and faster later.

This is why early action matters.

Simple Example to Understand

Loan amount ₹50 lakh

Tenure 20 years

Interest rate 9 per cent

In the first year

- A significant part of EMI is interest

- The loan balance reduces very little

In the last year

- Almost complete EMI goes to the principal

- Interest is minimal

If you prepay early, you minimise interest on the remaining years.

Why Prepayment Timing Is Important

Prepayment works best in the early years of the loan.

If you prepay in the first 5 years

- Outstanding balance reduces

- Future interest reduces sharply

- Total loan cost drops

If you prepay in the last few years, savings are limited.

Isliye early prepayment ka fayda zyada hota hai.

How to Use an Amortisation Schedule for Prepayment Planning

Identify High-Interest Years

Check which years you are paying the most interest. These are your target years for prepayment.

Decide Prepayment Amount

Even small prepayments help.

Example

Prepaying ₹1 lakh in year 2 saves more interest than ₹1 lakh in year 10.

Choose EMI Reduction or Tenure Reduction

Most banks give two options

- Reduce EMI

- Reduce tenure

Reducing tenure saves more interest in most cases.

Update Schedule After Prepayment

After prepayment, request a revised amortisation schedule from the bank. This helps you track progress.

Common Prepayment Mistakes in India

- Prepaying late in the loan tenure

- Reducing EMI instead of tenure without calculation

- Ignoring prepayment charges

- Using emergency savings for prepayment

- Not checking the revised schedule

Prepayment should not create cash flow stress.

Are There Any Prepayment Charges?

For most floating-rate home loans in India, there are no prepayment charges. Personal and fixed-rate loans may incur fees.

Always check loan terms before prepaying.

How Amortisation Helps Credit Profile

Prepayments reduce the loan outstanding, which helps in

- Lower EMI stress

- Better credit utilisation

- Improved loan eligibility later

Regular tracking also helps you monitor your credit score and plan future borrowing more effectively.

Final Thoughts

An amortisation schedule is not just a boring table. It is a powerful planning tool.

Once you understand where your money is going, you can decide when and how much to prepay. Thoda calculation aur thoda discipline can save you years of EMIs and lakhs in interest.

Loan ko control karo, loan tumhe control nahi karega.

FAQs

Is the amortisation schedule the same for all loans?

No. It differs based on loan amount, interest rate, and tenure.

When is the best time to prepay a loan?

The early years of the loan offer the most significant interest savings.

Should I reduce EMI or tenure after prepayment?

Reducing tenure usually saves more interest.

Do banks update the amortisation schedule automatically?

Sometimes yes, but it is better to request an updated schedule.

Does prepayment improve credit score?

It helps indirectly by reducing outstanding loans and EMI burden.