EMI bounces are among the most common causes of credit score damage in India. Many people have sufficient income yet still default on EMI. The reason is usually simple. The EMI due date does not match the salary cycle.

Choosing the right EMI due date is a small decision, but it plays a significant role in avoiding penalties, stress, and credit score drops. Let’s understand how to pick the best EMI due date based on your salary pattern.

Why EMI Due Date Matters More Than You Think

Banks treat EMI bounces very seriously.

Even one missed EMI can lead to

- Late payment charges

- Penal interest

- Negative entry in the credit report

- Drop in credit score

Most bounces occur not because people cannot pay, but because funds are not available on the scheduled date.

Thoda timing ka issue, aur problem ho jaati hai.

How Salary Cycle Works for Most Indians

In India, salaries are usually credited on

- Last working day of the month

- 1st to 5th of the following month

- Fixed date like 7th or 10th

But EMIs are often scheduled on random dates, such as the 1st, 3rd, or 25th, without accounting for salary credit.

This mismatch is the root cause of many EMI failures.

Best EMI Due Date If Salary Comes at Month End

If your salary comes on the last working day or the 1st of the month, your best EMI due date is

- Between 5th and 10th

This gives you

- Time for salary credit

- Buffer for bank delays

- Room for unexpected expenses

Avoid EMI dates on the 1st or 2nd, as salary credits can get delayed due to holidays.

Best EMI Due Date If Salary Comes Between 5th and 10th

If your salary comes around the 7th or 10th, your EMI date should be

- Between 12th and 18th

This ensures

- Salary is already credited

- You have checked your balance

- You can manage multiple EMIs better

Never keep the EMI date before your salary date.

Best EMI Due Date If Salary Is Irregular

This is common for

- Freelancers

- Consultants

- Business owners

In such cases

- Keep the EMI date closer to mid-month

- Maintain extra balance always

- Avoid early-month EMIs

For irregular income, buffer matters more than exact timing.

Income thoda upar neeche hota hai, so planning aur zaroori hai.

Why Early Month EMI Dates Are Risky

Many people choose early EMI dates, thinking it will finish obligations quickly. This often backfires.

Problems with early EMI dates

- Salary may be delayed

- Bank holidays affect credits

- Rent or bills may already be deducted

- Low balance risk increases

Early EMI dates look attractive on paper, but are risky in practice.

How Multiple EMIs Change the Decision

If you have more than one EMI

- Space them out

- Do not keep all EMIs on the same date

- Align the biggest EMI first after salary

Example

- Home loan EMI on 7th

- Car loan EMI on 15th

- Personal loan EMI on 20th

This reduces pressure and bounce risk.

How to Change EMI Due Date in India

Most banks allow EMI date change.

Steps usually include

- Request through customer care or the branch

- Choose new date options offered by the bank

- One-time processing fee may apply

It is better to change the EMI date once than face repeated bounces.

EMI Due Date and Credit Score Connection

EMI bounces directly affect your credit score.

- One bounce can reduce the score

- Repeated bounces hurt loan eligibility

- Banks see payment discipline as the top priority

Choosing the right EMI date helps protect your credit score without extra effort.

Regular tracking also helps you check credit score changes and catch issues early.

Common EMI Due Date Mistakes to Avoid

- Choosing the EMI date before the salary credit

- Keeping all EMIs on the same day

- Not updating the date after a job change

- Assuming the bank will retry the debit automatically

- Ignoring mandate failure messages

These small mistakes can create long-term problems.

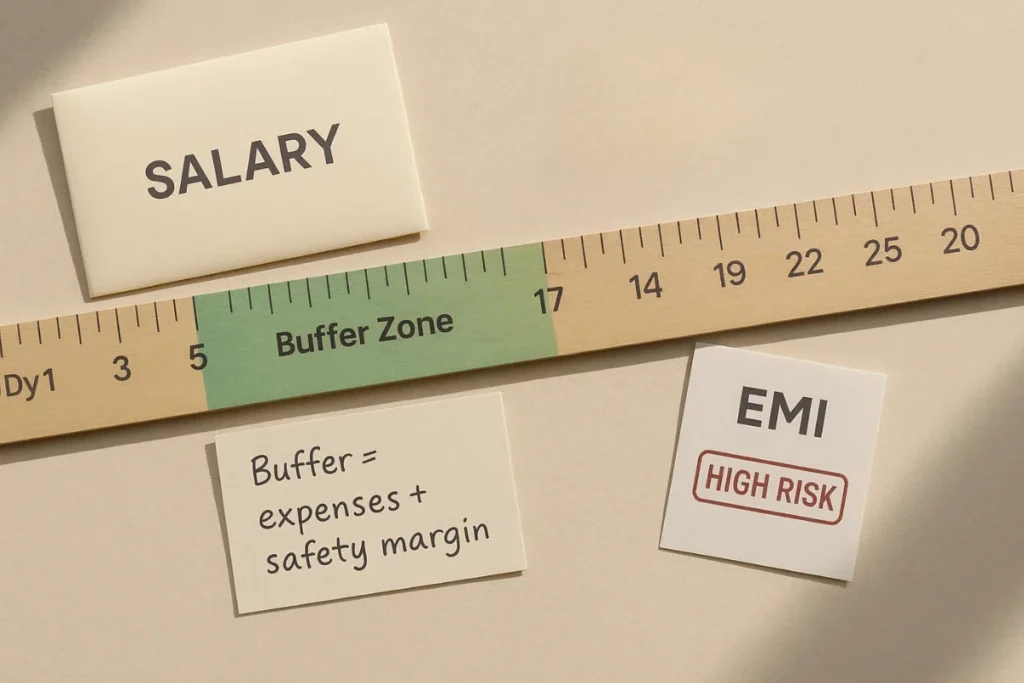

A Simple Rule to Pick the Best EMI Due Date

Use this rule

- EMI date should be 3 to 7 days after salary credit

- Keep at least a one-week buffer

- Avoid holidays and the month-end rush

This one rule works for most salaried Indians.

What If You Already Had EMI Bounces

Do not panic.

- Clear dues immediately

- Fix EMI date mismatch

- Inform the lender if the payment was manual

- Monitor the credit report in the next cycle

One correction can prevent future damage.

Final Thoughts

Choosing the best EMI due date is not about convenience. It is about safety.

A well-chosen EMI date helps avoid bounces, penalties, and damage to your credit score. Align your EMI with your salary cycle and give yourself a buffer. Thoda planning aaj karein, to EMI tension kal nahi hogi.

FAQs

What is the safest EMI due date in India?

Usually, 5 to 10 days after salary credit is applied is the safest.

Can I change the EMI due date after the loan starts?

Yes. Most banks allow it with a simple request.

Does EMI bounce affect credit score?

Yes. Even one bounce can impact your score.

Should all EMIs be on the same date?

No. Spacing them reduces risk and stress.

Does salary delay cause EMI bounce?

Yes. That is why buffer days are essential.