A home loan balance transfer is one of the easiest ways to reduce your EMI and total interest cost in India. Many borrowers stick with their original bank for years, even when better rates are available. With interest rates changing often, switching your home loan can save lakhs if done at the right time.

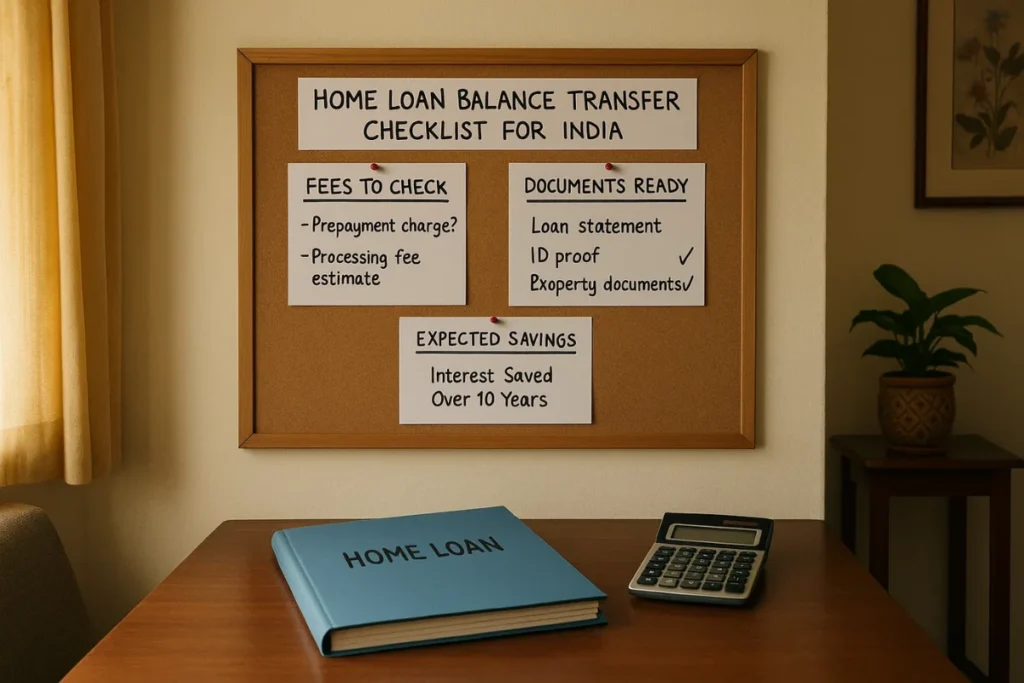

But a balance transfer is not just about a lower interest rate. You need to review fees, documentation, and actual savings before making the move.

What Is a Home Loan Balance Transfer?

A home loan balance transfer is the process of moving your existing home loan from your current bank to a new bank that offers a lower interest rate.

The new bank repays your old loan, and you start paying EMIs to the new lender.

This is allowed in India and is quite common, especially for long-term loans.

When Does a Balance Transfer Make Sense?

A balance transfer usually makes sense if

- Your remaining loan amount is high

- Loan tenure left is more than 5 years

- The interest rate difference is at least 0.5 to 1 per cent

- Your credit profile is stable

If your loan is close to closure, savings may be limited.

Fees Involved in Home Loan Balance Transfer

Before switching, understand the costs clearly.

Processing Fee

A new bank usually charges

- 0.25 to 1 per cent ofthe loan amount

- Sometimes capped at a maximum amount

Some banks offer a zero processing fee during special offers.

Legal and Valuation Charges

These include

- Property valuation

- Legal verification

- Documentation charges

These are usually one-time costs.

Foreclosure Charges

For floating-rate home loans in India, foreclosure charges are typically zero.

Still, confirm this with your current bank.

Fees reduce savings, so always calculate the net benefit.

Documents Required for Balance Transfer

Most banks ask for similar documents.

Loan Related Documents

- Existing loan sanction letter

- Latest loan statement

- Foreclosure letter from the current bank

Property Documents

- Sale agreement

- Allotment letter

- Approved building plan

Income Documents

- Salary slips or income proof

- Bank statements

- Updated KYC documents

Having documents ready speeds up the process.

How Much Can You Actually Save?

Savings depend on

- Interest rate difference

- Outstanding loan amount

- Remaining tenure

Example

Outstanding loan ₹40 lakh

Tenure left 15 years

The rate was reduced by 1 per cent

Savings can run into several lakhs over the life of the loan.

Yahin pe balance transfer ka real benefit dikhta hai.

EMI vs Tenure After Transfer

After a balance transfer, banks may

- Reduce EMI

- Reduce tenure

Reducing tenure usually saves more interest.

Always ask the bank what option they are applying and whether you can choose.

Credit Score Requirement for Balance Transfer

Banks check your credit score before approving a transfer.

Generally

- 750 and above get the best rates

- 700 to 749 is acceptable

- Those below 700 may face rejection or higher rates

Before applying, it is smart to check your credit score and fix minor issues if needed.

How Long Does the Process Take?

Balance transfer usually takes

- 2 to 4 weeks

Delays happen if

- Documents are missing

- Property papers are incomplete

- Valuation issues arise

Planning helps reduce stress.

Risks and Things to Watch Out For

Do not switch blindly.

Watch out for

- Teaser rates that increase later

- High reset spreads

- Hidden charges

- Mandatory insurance bundling

Always read the sanction letter carefully.

Common Mistakes Borrowers Make

- Switching for minimal rate difference

- Ignoring fees while calculating savings

- Not checking the revised EMI or tenure

- Applying to multiple banks at once

Thoda calculation aur patience zaroori hai.

Simple Balance Transfer Checklist

Before applying, tick these boxes

- Loan tenure is more than 5 years

- Interest difference of at least 0.5 per cent

- Fees are less than savings

- Credit score in a good range

- Documents ready

If most answers are yes, transfer makes sense.

Final Thoughts

A home loan balance transfer can be a powerful way to reduce EMI and interest burden in India, but only if done after proper calculation. A lower rate alone is not enough. Fees, tenure, and long-term savings matter equally.

Plan carefully, compare properly, and then switch—Thoda effort aaj karein, to future ka interest kaafi kam ho jaata hai.

FAQs

Is a balance transfer allowed multiple times?

Yes, but frequent transfers may attract higher scrutiny.

Does a balance transfer affect a credit score?

A slight temporary dip may happen, but it stabilises with timely payments.

Can I negotiate with my existing bank instead?

Yes. Many banks reduce rates to retain customers.

Is the processing fee refundable?

Usually, no, even if you cancel later.

Is a balance transfer good during rate hikes?

Yes, if another bank still offers a better effective rate.