A credit score of 650 is workable, but you will face higher interest rates and tougher approvals. The good news is that moving from 650 to 750 is realistic with a few focused habits. Your score is built on payment history, credit utilisation, account age, credit mix, and new enquiries. If you improve these areas together, your score can climb steadily within a few reporting cycles.

Step 1: Pay Every Bill in Full and On Time

Payment history has the most significant impact.

- Clear credit card bills in full before the due date.

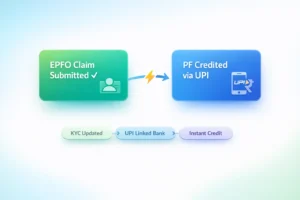

- Set auto debit or UPI reminders for EMIs and cards.

- If you missed a payment recently, get back on track with on-time payments from this month. Consistency for two or three cycles usually shows positive movement.

Step 2: Cut Credit Card Utilisation Below 30 Percent

High utilisation is the most common reason scores get stuck around 650.

- Keep spending under 30 percent of your total card limits.

- If needed, request a credit limit increase from your bank. Do not increase spending once the limit increases.

- Pay mid-cycle to bring utilisation down before the statement is generated. This single habit can add quick points.

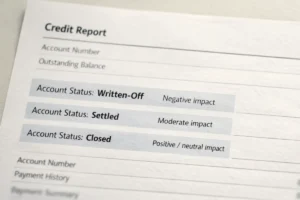

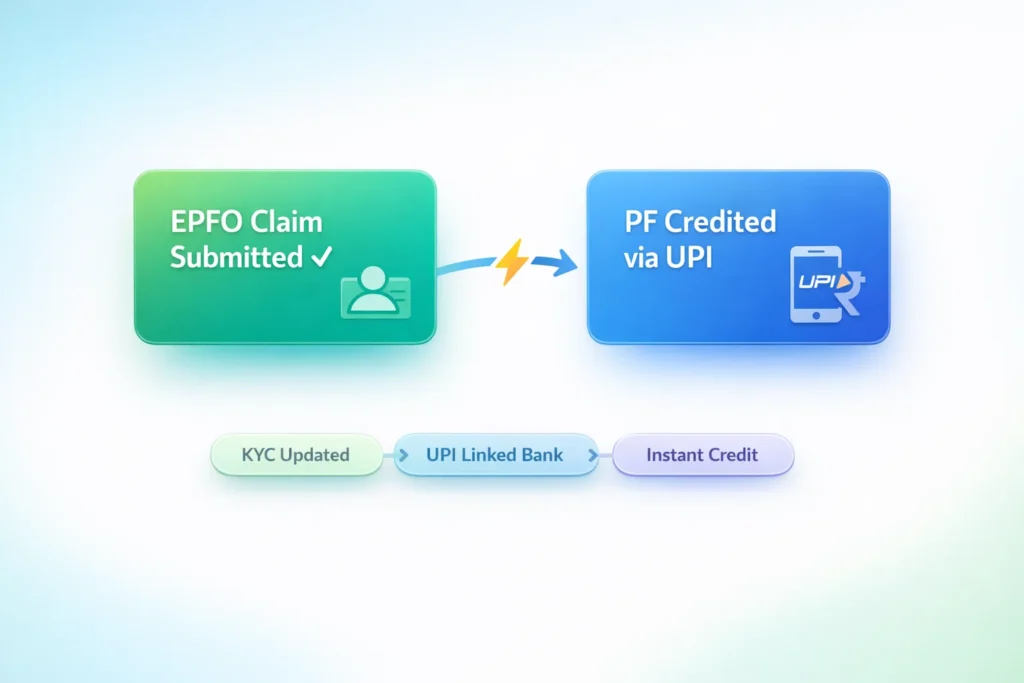

Step 3: Fix Errors in Your Credit Report

A slight mistake can hold your score down for months.

- Download your latest report and scan for wrong late marks, closed loans still showing active, or duplicate entries.

- Raise a dispute with the bureau and email your lender with proof, like statements or NOC.

- Recheck after one reporting cycle. A corrected file often gives a noticeable lift.

Step 4: Reduce Costly Card Balances and Personal Loans

Rolling balances and high-interest loans drag the score.

- Prioritise clearing credit card dues first.

- Make part prepayments on personal loans if you have surplus cash. Even one or two prepayments lowers your interest load and improves your risk profile.

- Avoid using the card for discretionary purchases until the score crosses 720.

Step 5: Build a Healthy Credit Mix

Lenders like to see that you can handle different types of credit.

- If you have only credit cards, consider keeping one small secured loan active, such as a low-value consumer durable EMI.

- New to credit? Users can start with a secured credit card backed by a fixed deposit. Use lightly and pay in full.

Step 6: Avoid New Credit Enquiries For a While

Too many applications in a short time reduce the score.

- Do not apply for multiple cards or loans at the same time.

- If a lender has already rejected, wait two to three months, improve utilisation and history, then try again.

Step 7: Keep Old Accounts Open

The age of your oldest account supports your score.

- Do not close old credit cards unless there is a fee you cannot justify.

- Put a small monthly spend on older cards and pay in full to keep them active.

A 60 Day Action Plan

Week 1 to 2

- Set auto debit for all bills.

- Bring utilisation under 30 percent by a part payment.

- Review the report and list any errors.

Week 3 to 4

- File disputes with supporting documents.

- Request a credit limit increase on your primary card if your repayment record is clean.

- Stop new applications and reduce impulse spending.

Week 5 to 8

- Keep utilisation low and payments perfect.

- Make one part prepayment on the costliest loan if cash allows.

- Download a fresh report to confirm dispute resolution.

Habits That Keep You Above 750

- Pay in full, every time, without fail.

- Keep utilisation low across all cards.

- Review your report every three to six months.

- Space out applications and protect the age of your accounts.

- Track progress on a trusted check credit score platform so you can react early if anything slips.

What Results To Expect

Scores rarely jump overnight, but steady habits work. Many users see meaningful improvement in two or three reporting cycles when they combine on-time payments, low utilisation, and a clean report. Do not chase quick fixes. Lenders value consistency more than one-time spikes.

Thoda discipline rakho, EMI aur bill time par clear karo, aur card limit ka use kam rakho. Score apne aap upar aayega. Bas regular tracking aur simple habits follow karo, 650 se 750 tak ka safar smooth ho jayega.