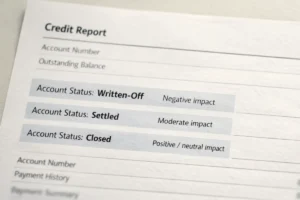

When you apply for a loan or credit card, the first thing banks check is your credit score. In India, two major credit bureaus — CRIF High Mark and CIBIL (TransUnion CIBIL) — are commonly used to assess your creditworthiness. Both play an essential role in helping lenders make safe lending decisions, but many people are unsure which one banks trust more.

The truth is, both CRIF and CIBIL are RBI-approved credit bureaus, and banks rely on data from both. The difference lies in how each bureau collects and updates information, not in its reliability.

What Is CIBIL?

CIBIL (TransUnion CIBIL) is India’s oldest and most recognised credit bureau. It collects data from banks, NBFCs, and other lenders to create your credit profile. CIBIL scores range from 300 to 900, and lenders often check this score before approving loans or credit cards.

What Is CRIF High Mark?

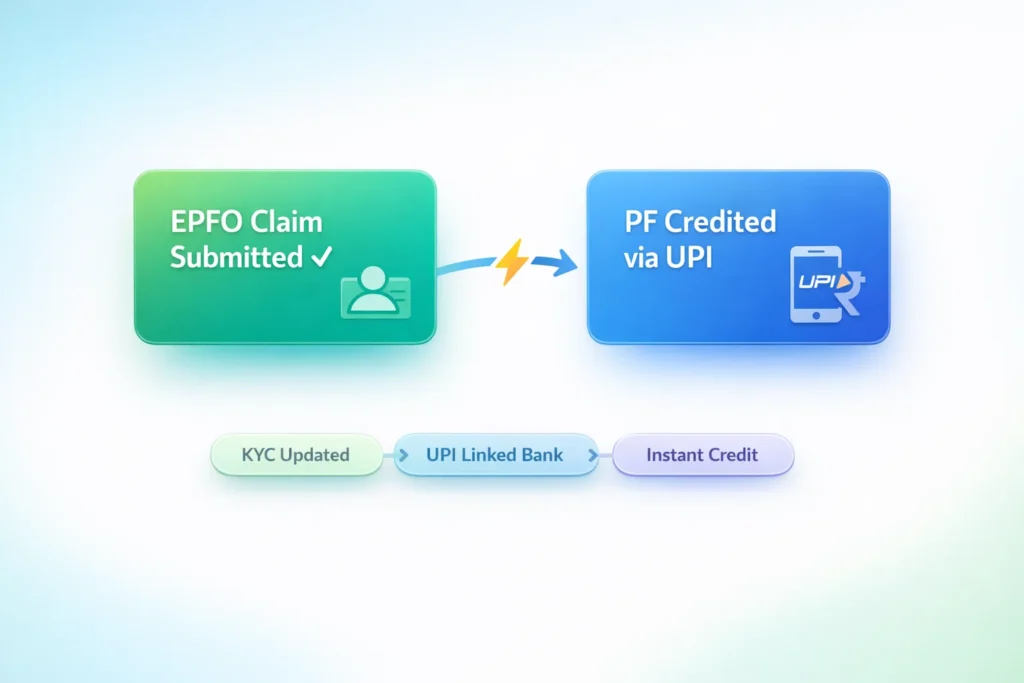

CRIF High Mark is another RBI-licensed credit bureau that has grown rapidly in India. It tracks your credit cards, loans, and repayment history across various lenders — just like CIBIL. CRIF is known for offering detailed, updated, and data-rich reports. Many banks, fintech companies, and NBFCs use CRIF reports to make quick, accurate lending decisions.

CRIF also provides a complete view of your credit health, helping users understand their score, payment trends, and overall financial behaviour. You can easily check your own CRIF score on platforms like check CRIF credit score, which show your report in a clear, easy-to-read format.

CRIF vs CIBIL – Quick Comparison for Indian Users

| Feature | CRIF High Mark | CIBIL (TransUnion CIBIL) |

| Founded | 2010 | 2000 |

| Approved by RBI | ✅ Yes | ✅ Yes |

| Credit Score Range | 300 – 900 | 300 – 900 |

| Data Coverage | Banks, NBFCs, microfinance, and fintech lenders | Mostly banks and large NBFCs |

| Report Type | Detailed report with full credit summary and payment trends | Standard report with score and credit history |

| Update Frequency | Regular monthly updates from lenders | Regular monthly updates from lenders |

| Used By | Banks, NBFCs, and many fintech apps for quick digital lending | Major banks and NBFCs for traditional lending |

| User Access | Available through the check CRIF credit score | Available through CIBIL’s official website |

| Ease of Understanding | Clear layout and insights for users | Standard layout, fundamental insights |

| Accuracy and Reliability | Used widely by fintech and digital lenders | Highly trusted by banks and financial institutions |

Do Banks Prefer One Over the Other?

Banks and NBFCs do not rely on a single bureau. Some lenders integrate directly with CIBIL, while others use CRIF or multiple bureaus to verify borrower details. Both bureaus provide accurate data and follow RBI guidelines for reporting.

What matters most is your credit behaviour, not which bureau you use. Whether a bank checks CIBIL or CRIF, your approval depends on how responsibly you manage loans and credit cards. Timely EMI payments, low credit utilisation, and regular score checks will keep you in good standing with all lenders.

Why CRIF Scores Are Becoming Popular

- CRIF offers strong data coverage across banks and NBFCs.

- It provides deep insights into credit usage and repayment trends.

- Many digital lenders and fintechs prefer CRIF for faster, more informed loan decision-making.

For users, CRIF’s reports are clear, detailed, and easy to understand — making it a preferred choice for tracking and improving credit health.

Final Thoughts

Both CIBIL and CRIF are trusted and accurate. Banks use both depending on their internal systems. But for individuals, regularly tracking your CRIF credit report helps you stay aware of your score and maintain a positive credit history.

Bas yaad rakho — credit score high rakho, payment time par karo, aur apni CRIF report check karte raho—strong score hoga to loan aur credit card dono asaani se milenge.