Building a 750+

Credit Score is easy!

Actionable Advice, Easy Repayments,

Better Rewards

Better Rewards

5.2+ M

Active Users

Active Users

4.7 / 5

Highly Rated

Highly Rated

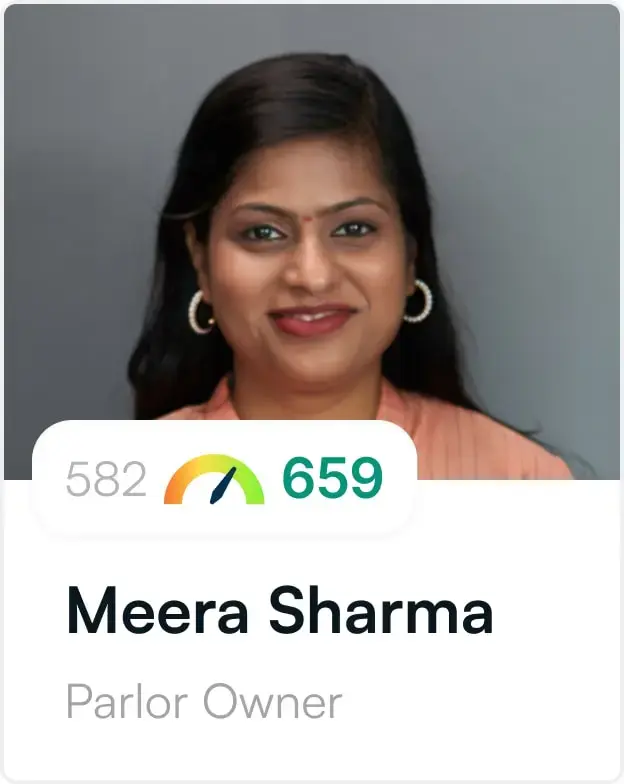

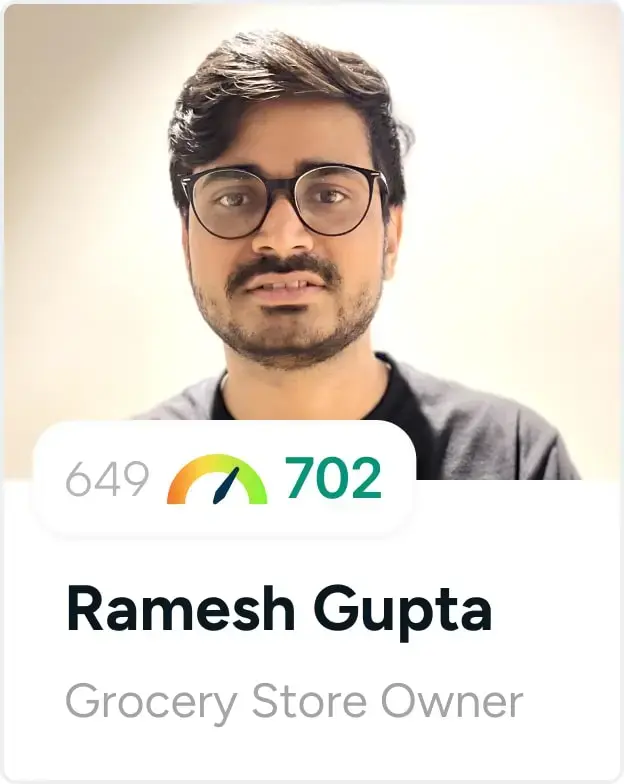

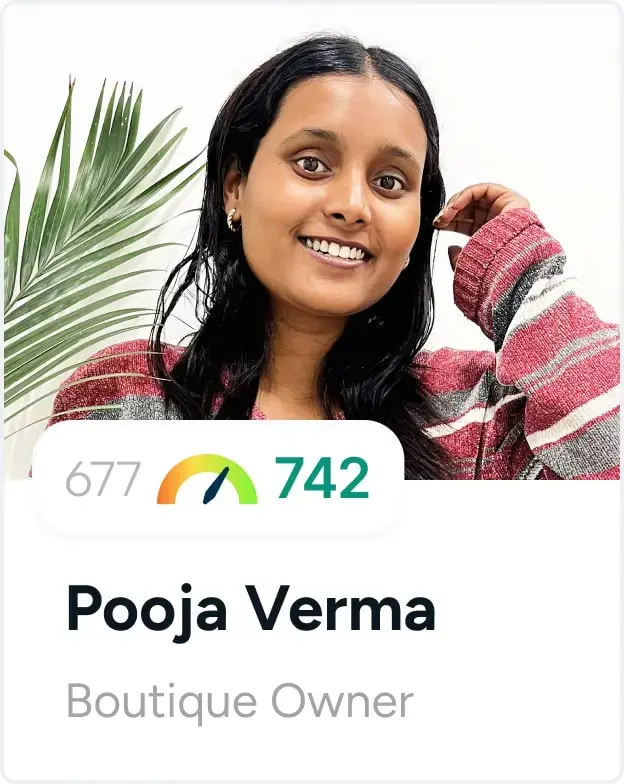

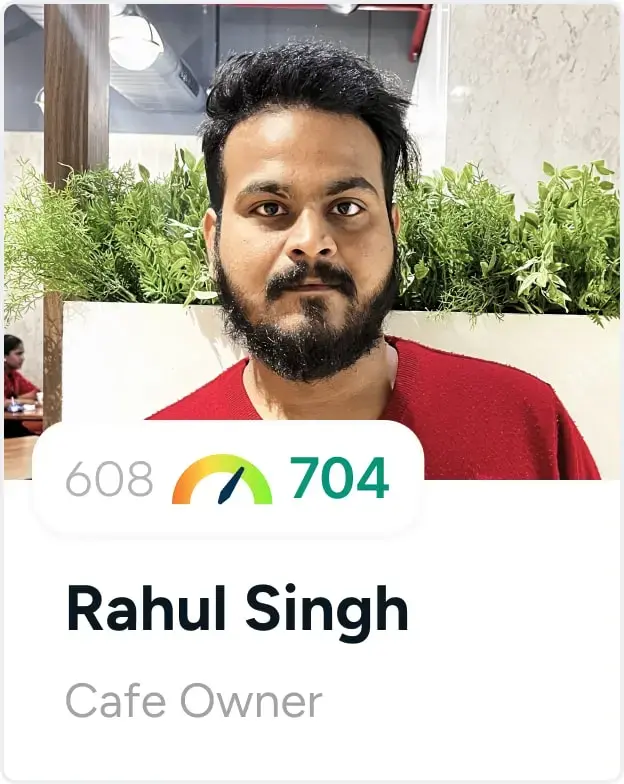

Helping Indians Improve Credit Score

11 Lakh+

Users Improved Score

15 Lakh+

Expert Advice Shared on Call

₹ 6,200 Cr+

User Loans Managed

With GoodScore App

Know exactly why your

Credit Score is low!

Missed payments?

Credit Utilization?

Frequent Loan Enquiries?

Errors & Fake Loans?

Get advice from Credit

experts

Personalized Video Guidance

Your credit report explained in detail

1 on 1 Consultation

Talk to experts for any financial advice

24 x 7 Chat Support

Instant help at your fingertips

One app to

Manage Loan Payments &

Earn Rewards

01

Loan Payment Tracker

02

Reminders & Autopay

03

Overdue payments in EMI

04

New Loan Offers

100% secure and encrypted

GoodScore means Good Savings!

Loan Amount

₹ 8.0 Lakhs

Save ₹47,235 extra with high credit score!

Credit Score:

680Low

Interest rate

@11.00%

Total interest amount

₹ 2,43,636

Credit Score:

750High

Interest rate

@9.00%

Total interest amount

₹ 1,96,401

10 Lakhs + Happy

Customers & Growing

0

0

0

0

0

0

0

0

0

0

0

0

0

0

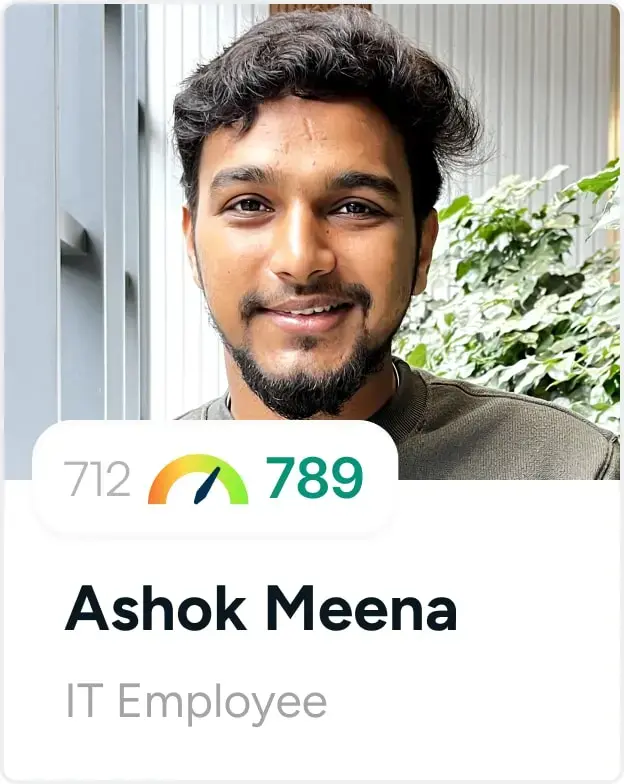

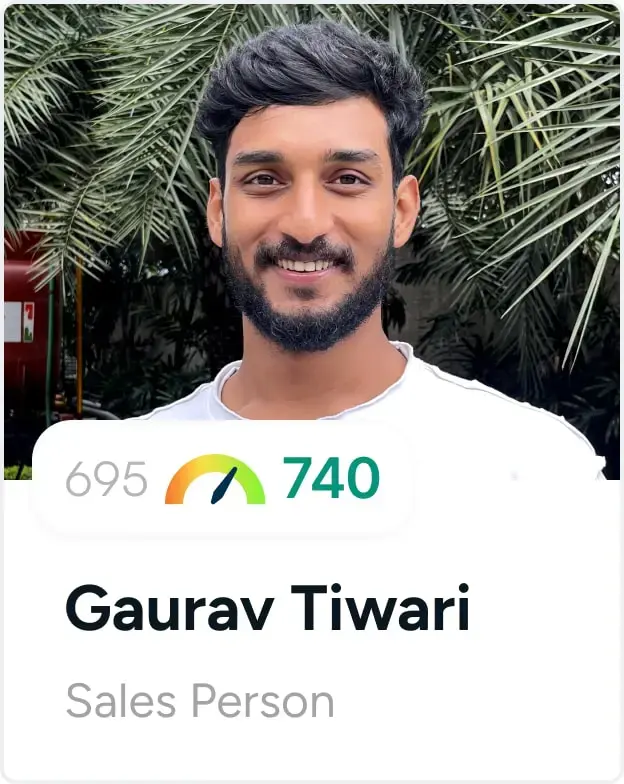

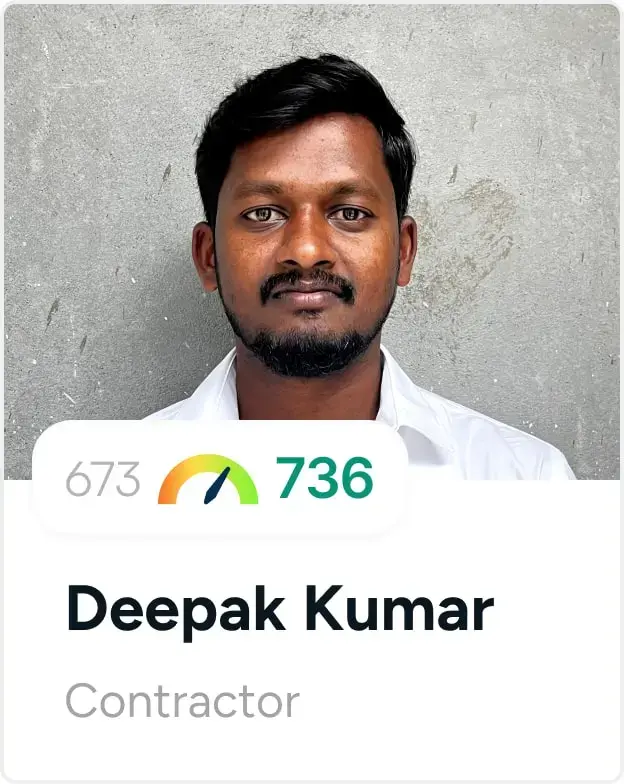

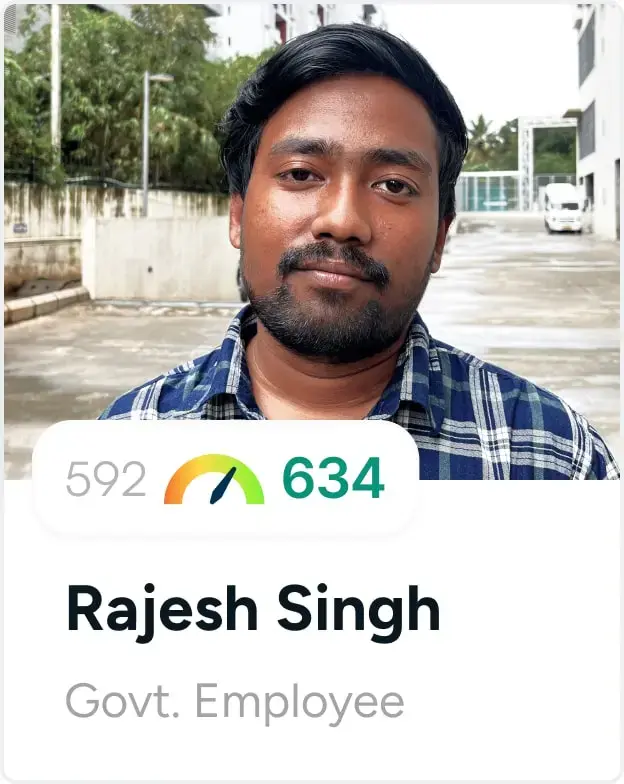

Customers Improved their Credit Score...

Our customers speak highly about us!

100% Secured

Most Trusted App

Improve your

Credit Score to 750+

Credit Score to 750+

Frequently asked

questions

questions

What is a credit score and how much is a good credit score?

A credit score is a numerical rating that reflects your creditworthiness based on your financial history. It typically ranges from 300 to 900. A score above 750 is generally considered good, increasing your chances of loan approval and better interest rates from lenders.

Why is a good credit score important?

A good credit score is important because it increases your chances of loan approval, lowers interest rates, and improves access to financial products like credit cards and mortgages. It reflects your financial responsibility and can also help you secure better terms on insurance, rental agreements, and more.

How is my credit score calculated?

Your credit score is calculated based on five factors: payment history (35%), credit utilization (30%), length of credit history (15%), types of credit (10%), and new credit inquiries (10%). Timely payments and low credit usage have the biggest impact, while having a mix of credit types and a long credit history also help boost your score. Frequent new credit applications can lower your score.

Will I get a loan for sure, if my credit score goes above 750?

A credit score above 750 significantly boosts your chances of getting a loan, and almost guarantees loan approval. But lenders also consider your income, employment status, existing debt, and credit history. Factors like the type of loan and the lender’s internal criteria also play a role. So while a high score improves your eligibility, approval depends on these additional factors as well.

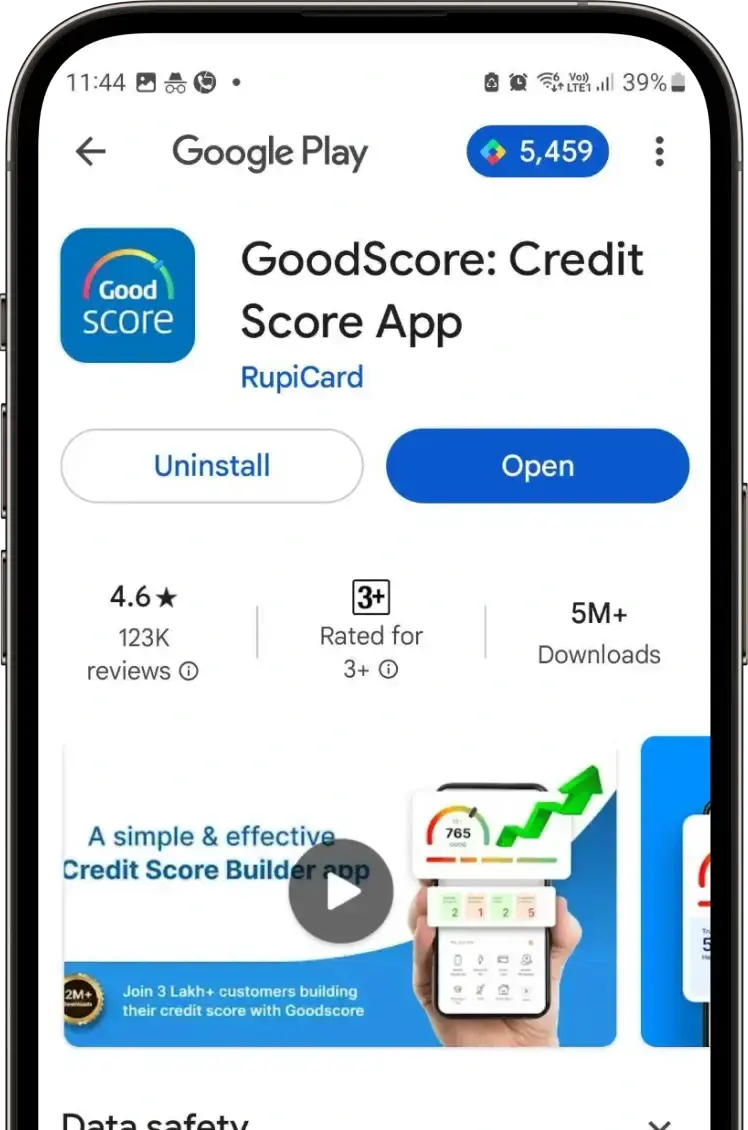

Why should I use the GoodScore app?

5 Million people use GoodScore for its all-in-one features.

| GoodScore | Others | |

|---|---|---|

| Check Credit Score | Y | Y |

| Get Credit Report | Y | Y |

| Personalized Video Guidance | Y | X |

| Score Improvement Plan | Y | X |

| 24 x 7 Chat support | Y | X |

| Expert Consultation on Call | Y | X |

| Loan payment & reminders | Y | X |

| Overdue loan management | Y | X |

| Resolution for fake enquiries & loans | Y | X |

What more can be done in the GoodScore app?

You can do electricity, water, internet and all other bill payments; and can also do Mobile Recharge with the GoodScore App. Very soon you’ll be able to scan and make UPI payments from the app. And there are exciting rewards & cashbacks for every transaction & bill payments.

Let Credit Expert help you increase your credit score

Powered by

Secured with

Social Media

Facebook

Instagram

YouTube

LinkedIn

Quick Links

Terms and Conditions

Privacy Policy

Blog

Grievance Redressal Policy

Refund and Cancellation Policy

Contact Us

080 - 69819392

help@goodscore.app

57/4, Vajram Esteva, 2nd Floor, Marathahalli-Sarjapur Outer Ring Road, ORR, Devarabisanahalli, Bengaluru, Karnataka 560103

Made with ❤️ in India.

© 2025 Arthvit 1809 Tech Pvt. Ltd. | All Rights Reserved

Made with ❤️ in India.

© 2025 Arthvit 1809 Tech Pvt. Ltd. | All Rights Reserved

WHAT IS GOODSCORE?

GoodScore helps you build your credit score to 750+. Our credit score is powered by Experian and CRIF High Mark - 2 of the 4 credit bureaus authorised by Reserve Bank of India.

HOW DO WE WORK?

We give you access to your detailed credit report after a thorough analysis of your credit profile in the form of personalised video guidance and a step-by-step plan.

Our team analyses all your active and closed credit accounts, and credit behaviour including payment history, defaults, credit utilisation, loan enquiries and balances - all of which are important factors that impact your credit score.

WHY SHOULD YOU USE THE APP?

We have designed the GoodScore app to empower you to take control of your financial well-being. Let’s walk you through the key features:

- Credit Score Tracking: Stay on top of your financial health by tracking your credit score every month. With a detailed credit report, you can easily monitor changes, spot discrepancies, and ensure your credit history is accurately reflected.

- Score Improvement Tips: We help you identify key factors impacting your credit score, offering tailored advice on how to improve them. With our expert guidance, you can work towards reaching a credit score of 750 or higher.

- Personalised Support: Receive a personalised video that explains your credit situation in detail, along with a step-by-step plan for improvement. Plus, enjoy 24x7 chat support to get real-time assistance whenever you need it.

- Account Overview: Easily manage your financial portfolio by tracking all your loans and credit accounts in one centralised location. This streamlined approach helps you stay organised and keep an eye on all your financial obligations.

- Payment Reminders: Never miss a payment again by setting timely reminders for your bills and EMIs. You can also set up autopay requests, ensuring your payments are always on time and helping you avoid late fees and interest charges.

- Bill Payments via BBPS: Seamlessly pay loan repayment EMIs, Credit Card and other utility bills via NPCI’s secure BBPS system.